Terrific blog post by Jonathan Zdziarski on Apple vs the FBI. I have to go and read his other posts. On Ribbons and Ribbon Cutters On Ribbons and Ribbon Cutters In my opinion this might be a defining issue whether this country preserves freedom or descends into tyranny. It is that important.

Author Archives: smilingdad

My Anti-Bucket List

Originally posted on Saving Without Scrimping:

This post has been inspired by the lovely Georgie Moon who shared some fantastic prompts. I really liked the idea of an anti-bucket list because when I consider a bucket list it’s a things to do. I want to swim with dolphins, go in a hot air balloon, and visit…

A lot has changed, but are things really different?

Hello everyone, I have missed interacting with you and reading your positive stories. It has been a long time since I was able to write here. Last month, after waiting five excruciating months, we were only able to refinance our house, take out some equity and pay off some high interest credit card payments. WeContinue reading “A lot has changed, but are things really different?”

An analysis of non-iPhone cash flow

Many people think Apple is just the iPhone and nothing else matters. I recently wrote a Seeking Alpha blog post separating Apple into iPhone and non-iPhone segments. In my mind it shows Apple is currently undervalued. What’s astonishing is that Google generates less operating cash flow than Apple’s non-iPhone segment, but due to growing fasterContinue reading “An analysis of non-iPhone cash flow”

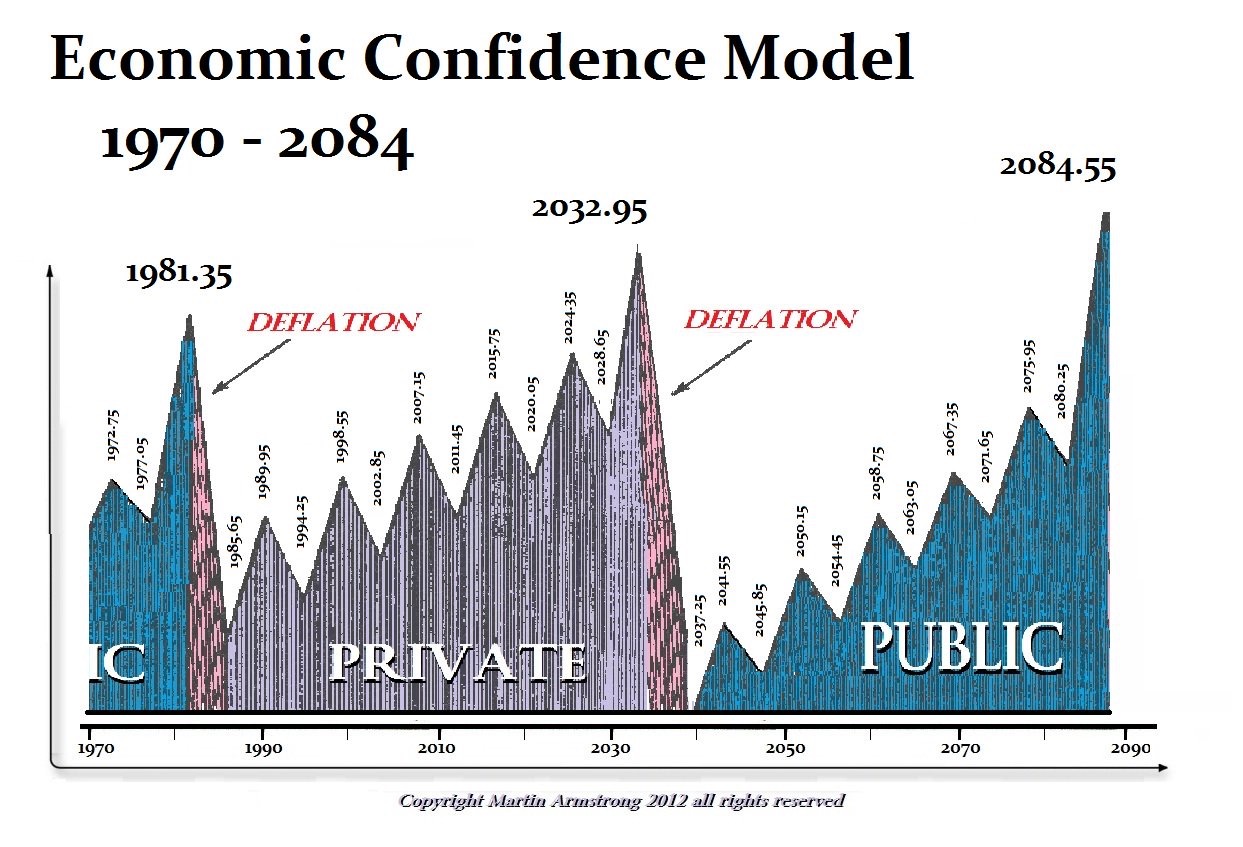

Repost: Socrates for the Conference

I have been waiting for this day for months. Martin Armstrong’s artificial intelligence system Socrates will be going live in the coming weeks. Socrates has been well known to make accurate financial and political calls decades in advance. Why is this important? Due to the specific time we live in many things will change rapidlyContinue reading “Repost: Socrates for the Conference”

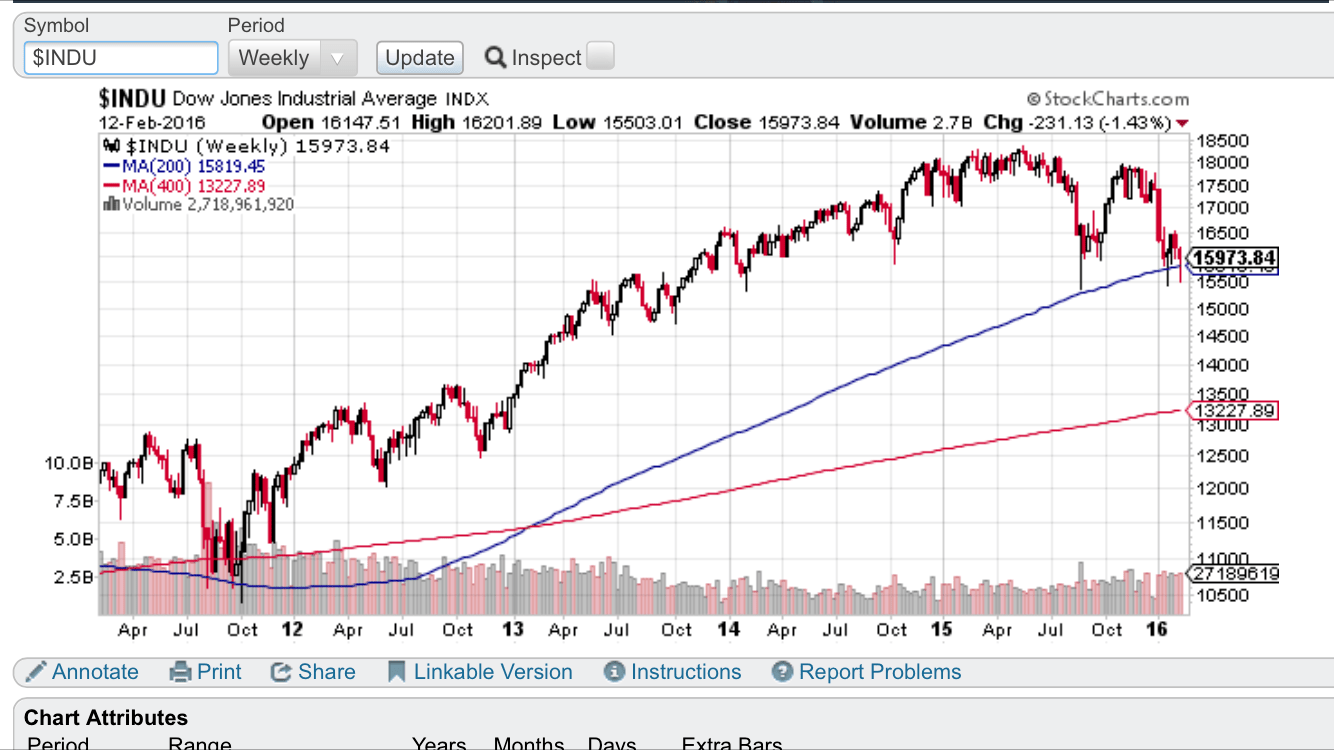

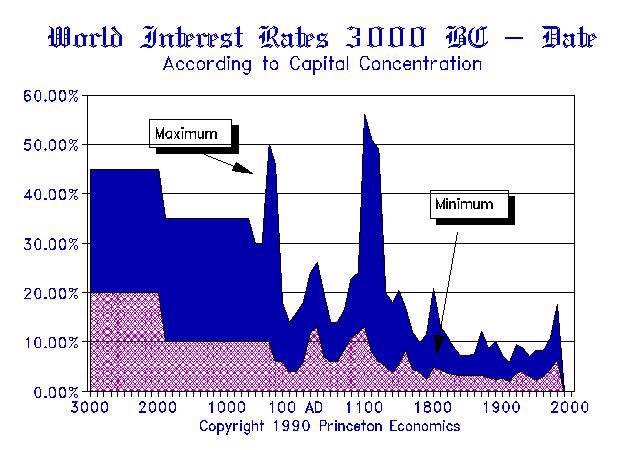

Must read: Debt Debt & more Debt 2015.75

Debt Debt & more Debt 2015.75 Must read article from Martin Armstrong. It succinctly explains their methodology and why having such a large database of history is very important. The Pi Cycle from 1970 is also clearly laid out. Deutsch Bank and VW on the merge of troubles right before the turn on the EconomicContinue reading “Must read: Debt Debt & more Debt 2015.75”

Fed doesn’t raise rates, world lets loose a sign of relief

Yesterday’s big story was the Federal Reserve didn’t raise interest rates. This keeps interest rates unraised since 2006. Everyone that has borrowed in US Dollars breathes a sigh of relief. I believe they should have raised. Retirees, insurance companies, pension funds, banks, and savers in the US would have appreciated the move. The stock marketsContinue reading “Fed doesn’t raise rates, world lets loose a sign of relief”

Happyness

Yes, happyness with a y. I define happyness as a prolonged contentment with life. I was thinking about this yesterday, as most of my posts so far have been financially related. Sure I have my financial goals, things I am working towards. And I will be happy when I reach them and can set evenContinue reading “Happyness”

Update on cash flow

Hello everyone, Here is an update on our cash flow situation. We are paying off any credit card debt we incur by setting aside an equal amount of cash to pay for variable expenses. That’s positive. Fixed expenses come straight from our paycheck. We are still in a negative cash flow situation but have aContinue reading “Update on cash flow”

What to expect from Apple next week

Next Tuesday Apple will be launching their new iPhone, the 6s. Predictions range all over the place, much of them based on hardware leaks. I think the hardware is well known but what will be interesting is the software that powers the hardware. Apple has rented a very large space, capable of seating 7,000 people.Continue reading “What to expect from Apple next week”