Hello everyone, Here is an update on our cash flow situation. We are paying off any credit card debt we incur by setting aside an equal amount of cash to pay for variable expenses. That’s positive. Fixed expenses come straight from our paycheck. We are still in a negative cash flow situation but have aContinue reading “Update on cash flow”

Category Archives: Personal Finance

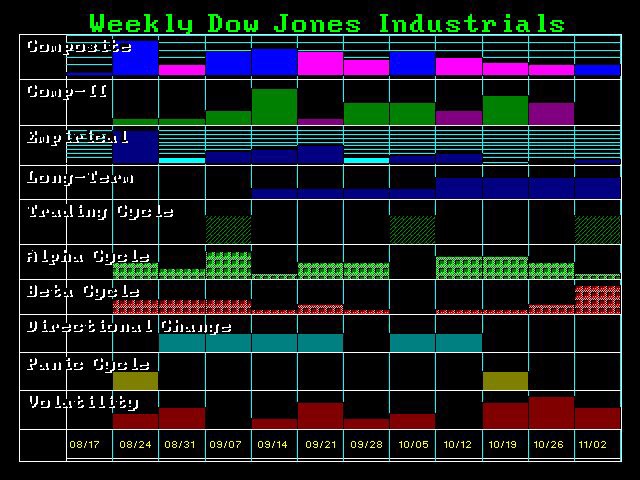

What happens tomorrow?

Armstrong Economics believes tomorrow is an important day for the markets. I believe Socrates is on to something. The closing on the Dow for the end of August will determine our path for the next few months. Here’s an article from Armstrong Economics regarding the importance of the monthly closing price for August. It cameContinue reading “What happens tomorrow?”

Free Cash Flow and Enterprise Value

Imagine you are an investor and you are looking to deploy your capital to buy a business. There are a variety of financial and non-financial measures you could use. One of the common measures is calculating the Free Cash Flow to Enterprise Value ratio. Let’s break down what they both mean. Free Cash Flow isContinue reading “Free Cash Flow and Enterprise Value”

Sell everything? Or hold on?

The market drama is gripping the financial markets this week. The age old question is should you sell everything and go to cash or should you hold on for the inevitable bounce? To answer that question I wanted to step back a bit. It would be meaningless to answer without some context on our savingsContinue reading “Sell everything? Or hold on?”

Investment wrap up 8/21/2015

Short summary, everything was horrifyingly bad in the U.S. Market. The Dow Jones entered correction territory, dropping by more than 3%, following yesterday’s 2% drop. This is the first time in more than 4 years we have seen a correction. All 10 major market sectors were down. September 30th / October 1st continues to beContinue reading “Investment wrap up 8/21/2015”

Actual spending vs. monthly budget

My family is making good progress on going from negative cash flow every month to cash flow positive. One of the things I did earlier was create an annual budget of all our expenses. For next month I am going to go one step further. I have taken that budget and divided by 12. ThisContinue reading “Actual spending vs. monthly budget”

Pay off debt or invest? Part two

My last post I shared whether if you were given 30,000 dollars to invest the money and pay off your debt later or pay off the debt immediately? A friend of mine told me he would rather invest. He had two main reasons. One, he would rather own more assets against the pool of debt.Continue reading “Pay off debt or invest? Part two “

Pay off debt or invest?

Suppose someone would give you 30,000 on one condition. You had to choose between two choices, pay off debt or invest it. Which would you choose? A friend and I were having a discussion on the topic. I’ll share his strategy next post. He said to invest, I said to pay off debt. Let’s assumeContinue reading “Pay off debt or invest?”

Financial Experience #2 – using the budget

Yesterday I mentioned how we started a budget. That budget detailed all of our expenses for the whole year. Items in red were areas we could take immediate action to reduce the expense. Some of the items in red were the following: Federal taxes and 401k contributions Cellular service Gym membership Internet service Of allContinue reading “Financial Experience #2 – using the budget “

Financial Experience #1 – having a budget

I want to share my experience on creating a budget. We didn’t have one. Not having one caused us much distress. Having a budget gave us control and a voice on how we wanted to live. It all started when I realized that our family was in a negative cash flow situation. This problem hadContinue reading “Financial Experience #1 – having a budget”