Hello everyone, I have missed interacting with you and reading your positive stories. It has been a long time since I was able to write here. Last month, after waiting five excruciating months, we were only able to refinance our house, take out some equity and pay off some high interest credit card payments. WeContinue reading “A lot has changed, but are things really different?”

Category Archives: Finance

Repost: Socrates for the Conference

I have been waiting for this day for months. Martin Armstrong’s artificial intelligence system Socrates will be going live in the coming weeks. Socrates has been well known to make accurate financial and political calls decades in advance. Why is this important? Due to the specific time we live in many things will change rapidlyContinue reading “Repost: Socrates for the Conference”

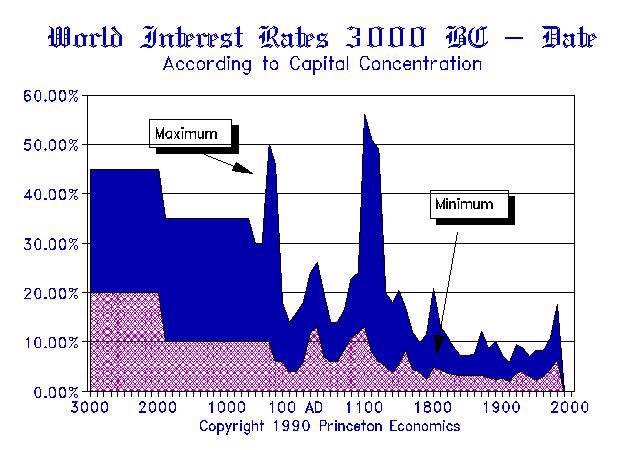

Fed doesn’t raise rates, world lets loose a sign of relief

Yesterday’s big story was the Federal Reserve didn’t raise interest rates. This keeps interest rates unraised since 2006. Everyone that has borrowed in US Dollars breathes a sigh of relief. I believe they should have raised. Retirees, insurance companies, pension funds, banks, and savers in the US would have appreciated the move. The stock marketsContinue reading “Fed doesn’t raise rates, world lets loose a sign of relief”

Update on cash flow

Hello everyone, Here is an update on our cash flow situation. We are paying off any credit card debt we incur by setting aside an equal amount of cash to pay for variable expenses. That’s positive. Fixed expenses come straight from our paycheck. We are still in a negative cash flow situation but have aContinue reading “Update on cash flow”

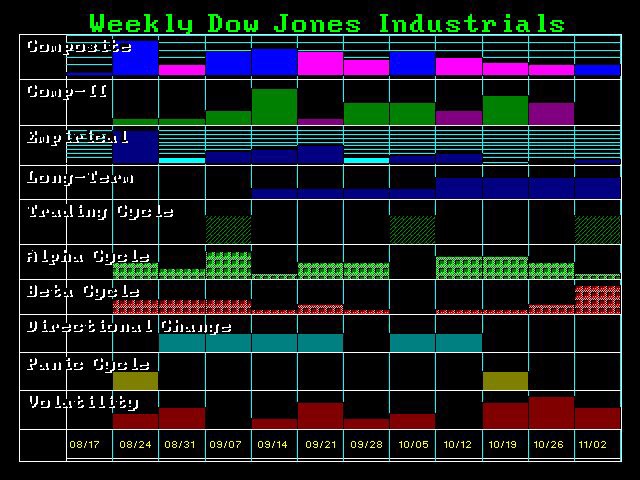

What happens tomorrow?

Armstrong Economics believes tomorrow is an important day for the markets. I believe Socrates is on to something. The closing on the Dow for the end of August will determine our path for the next few months. Here’s an article from Armstrong Economics regarding the importance of the monthly closing price for August. It cameContinue reading “What happens tomorrow?”

Free Cash Flow and Enterprise Value

Imagine you are an investor and you are looking to deploy your capital to buy a business. There are a variety of financial and non-financial measures you could use. One of the common measures is calculating the Free Cash Flow to Enterprise Value ratio. Let’s break down what they both mean. Free Cash Flow isContinue reading “Free Cash Flow and Enterprise Value”

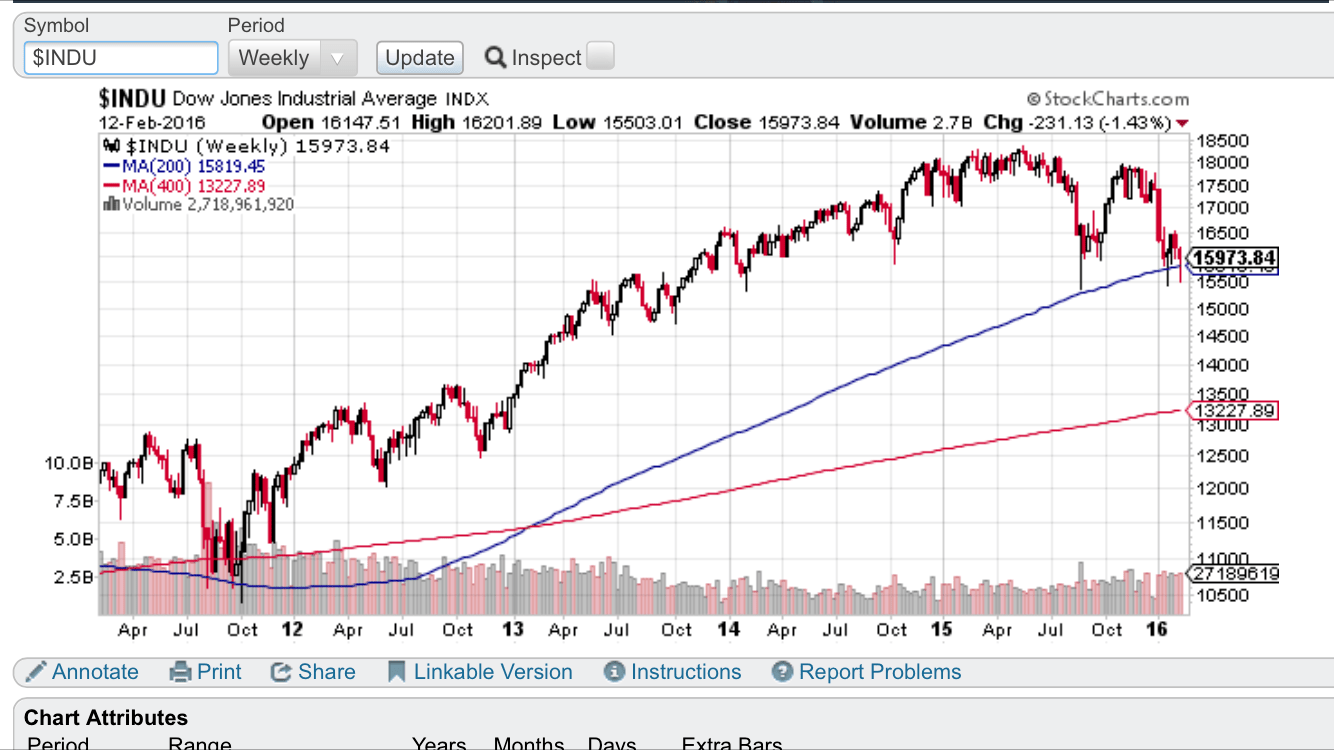

Sell everything? Or hold on?

The market drama is gripping the financial markets this week. The age old question is should you sell everything and go to cash or should you hold on for the inevitable bounce? To answer that question I wanted to step back a bit. It would be meaningless to answer without some context on our savingsContinue reading “Sell everything? Or hold on?”

Investment wrap up 8/21/2015

Short summary, everything was horrifyingly bad in the U.S. Market. The Dow Jones entered correction territory, dropping by more than 3%, following yesterday’s 2% drop. This is the first time in more than 4 years we have seen a correction. All 10 major market sectors were down. September 30th / October 1st continues to beContinue reading “Investment wrap up 8/21/2015”