Published on February 21st, 2025

The last two pieces we covered some simple ways to resist American fascism. They included boycotting Tesla, selling Tesla stock, locking your debit cards, freezing your credit reports, and buying gold related investments. Here, we urge those with foreign investments in the US to sell their US stocks and invest their proceeds at home. This will require governments to have some foresight to manage the flows back in a productive way.

Before we begin…

L’État, c’est moi (The State, it is me) – Louis XIV

He who saves his Country does not violate any Law – attributed to Napoleon (yes, that Napoleon)

“CONGESTION PRICING IS DEAD. Manhattan, and all of New York, is SAVED. LONG LIVE THE KING!” – “King” Dotard I, 2025 – ?

Suddenly, all three quotes have relevance.

The Goal

The goal is simple.

- Repatriate money currently invested in the US

- Strengthen your own countries

- Selling your US assets is another form of protest and ban

- Stick it to the US “King” and the US Lords by accelerating the Minsky cycle

Sell all US Stocks

The former democratic nation known as the USA is under the control of oligarchs, billionaires, and trillion dollar corporations. They don’t care about the environment. They don’t care about women’s rights or minority’s rights. They don’t care about democracy at home or abroad. They don’t care about those who died in wars or veterans. These oligarchs only care to increase their own power and wealth. As rich as they are, you can’t deny the smallness and pettiness of their hearts.

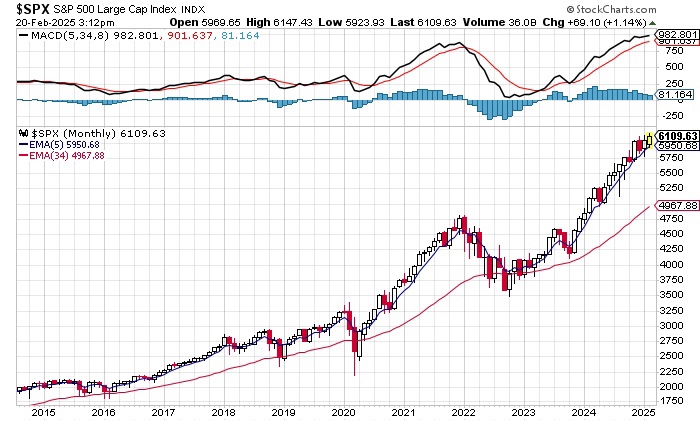

Since they only care about money, such as lower taxes, reduced competition and greater wealth, hurting the US stock market hurts them directly. The time to sell is now, with the largest 500 stocks in the country near all time highs. With the USA’s turn towards dictatorship and away from freedom, keeping your money invested in the US supports the oligarch’s looting the US and the world.

The current value of the S&P 500 today is $51,684,000,000,000 dollars (51.684 trillion dollars). See: Total S&P 500 Market Capitalization

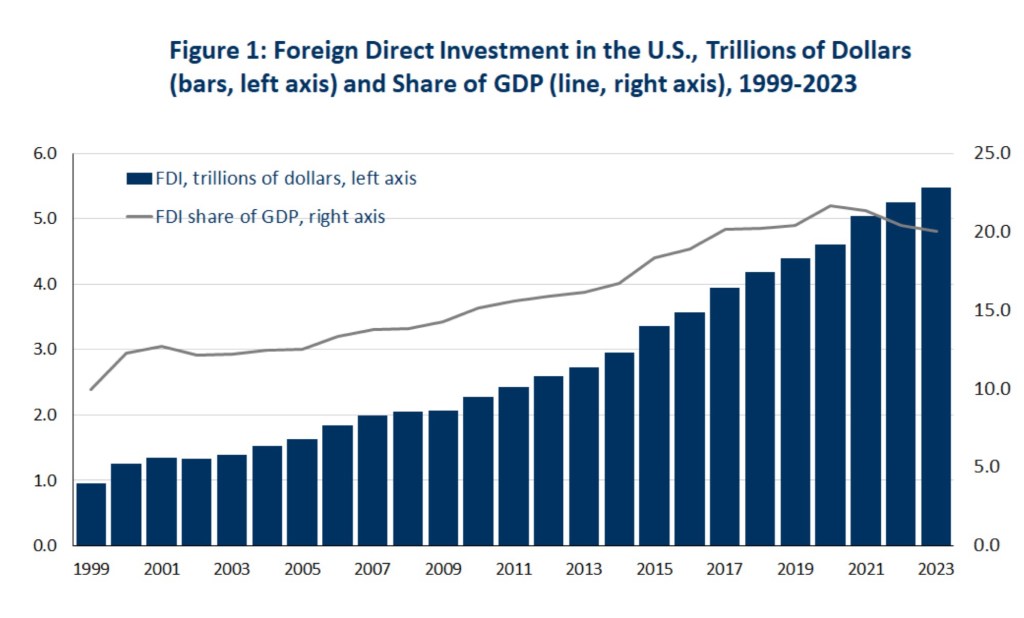

And foreign direct investment in the US totaled almost $6 trillion dollars as of September 2024, according to the Commerce Department.

I am sure the data through 2025 will show the value of FDI has increased in the US from 2023 levels, as the US stock market has gone greatly up.

We can see Japan, Canada, Europe, and Australia are the largest buyer of US assets. No longer is the US a benevolent giant spreading democracy and the rule of law for the benefit of the world. It might be rightly argued the US is transitioning to a criminal enterprise. Take the money and invest in your own citizens.

The Plan

My plan is simple, but probably hard to implement.

- Create a Bidenomics plan for your own country

- Encourage your citizens to repatriate money home at a slightly lower capital gains and losses rate

- Create public-private banks

- Encourage citizens to invest in such banks

- Each bank will be limited to a fractional reserve of 10%

- The banks create subsized loans

- Areas of interest

- Increased housing supply

- Enhancing climate resiliency

- Expanding power grids

- Enhancing broadband, rail, airports, roads, and ports

- Supply chain resiliency

- Helping businesses hurt by US tariffs

- Expanding trade with like minded nations

- Hiring more teachers, doctors, and nurses

- Promoting community papers

- Defense of the country

That means $6 trillion in assets has the potential to become $60 trillion due to the way banks operate. $60 trillion for the forces of good.

Would this idea work? What are your thoughts?

Resistance is NOT futile.

Word of the day: oligarchy

Oligarchy:

- government by the few

- a government in which a small group exercises control especially for corrupt and selfish purposes

Sincerely yours,

smilingdad

Copyright ©2017-2025 smilingdad. Copyright ©2023-2025 PokeAshVMax. All Rights Reserved. The content produced by this site is for entertainment purposes only. Opinions and comments published on this site may not be sanctioned by and do not necessarily represent the views of smilingdad, its owners, sponsors, affiliates, or subsidiaries.