Hello everyone, thank you for your patience. There have been some health challenges the last few months and our eBay / tcgplayer business is expanding! In today’s piece, I want to cover the Dow, S&P 500, Nasdaq, and Nvidia buy signals that were generated. The Dow is nearing 40,000, compared to 20,000 close to four years ago.

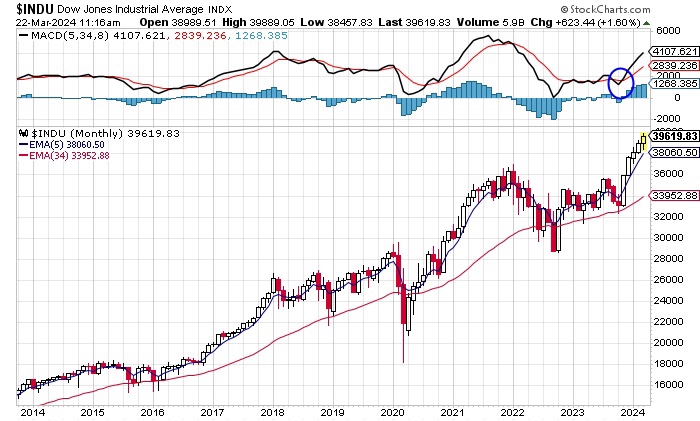

Dow

In late 2023, after the Fed raised interest rates numerous times, it looked like the Dow would go below the 34-month exponential moving average. This average provided major support at critical times. The Dow generated a monthly buy signal in 2023 Q4 (top panel, blue ellipse) and has not looked back in 2024 Q1. We are very close to the 40,000 mark, a far cry when we dipped close to 20,000 in 2020. With the Fed poised to lower rates three times this year, the labor market strong, stock markets soaring and inflation rates the Fed watches declining, it’s my belief the Dow will continue to go up in 2024. Trickle down economics and offshoring are no match for bottom up investment in America. If a sell signal is given, we’ll post it here.

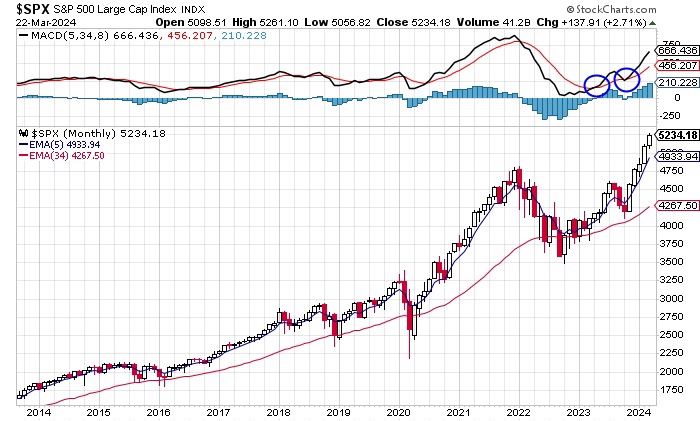

S&P 500

The S&P 500 generated 2 clear buy signals. The first happened earlier in 2023, and the second tested the sell signal and quickly reversed higher. The second buy signal is a sign of high momentum, which showed as the second rally had a steeper slope than the first. As the Dow and S&P 500 share a lot of components, we can see the index making all-time new highs.

Nasdaq

The Nasdaq is the last major index making an all-time new high. It is weaker gains than the other two, when you compare how far above the previous high we are. The Nasdaq is a study in contrasts. The clear buy signal in the upper panel shows in 2023 Q1 and a secondary buy signal in 2023 Q4.

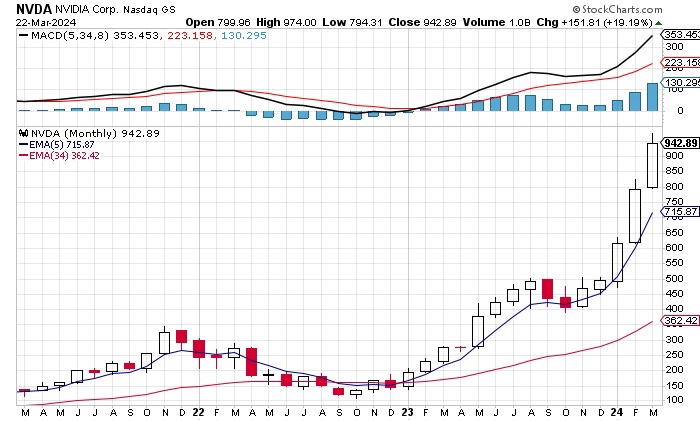

Nvidia

Holy wow. Look at Nvidia. With the buy signal given in early 2023, Nvidia has almost gained 400% in 15 months. I am always worried about the end of exponential runs. For the moment, momentum is strongly higher, on the backs of incredible fundamentals. Kudos to those that owned Nvida shares or options and held on. We sadly sold at $600 after buying at $500. When the next correction comes, and everyone wails that Nvidia’s done, use their pessimism to buy more shares.

Tesla

Tesla might be the newest poster child of what happens when a stock breaks its exponential run. The stock went from 20 to 400 in 2 years. A sell signal was given in early 2022 (black line goes below the red). The stock went from 100 to 300 before collapsing to 170 again on declining margins and low growth. Depending on your view, Tesla is consolidating past gains or declining. Tesla reminds me to always have a trailing stop loss so you preserve your gains. Follow a system, make money, sell when the system says it is time to go.

There are no shortage of opportunities at any time. We continue to outline a simple system that gets you onboard most of the major trends, and offloads your positions when markets turn against you.

Sincerely yours,

smilingdad

Copyright ©2017-2024 smilingdad. Copyright ©2023-2024 PokeAshVMax. All Rights Reserved. The content produced by this site is for entertainment purposes only. Opinions and comments published on this site may not be sanctioned by and do not necessarily represent the views of smilingdad, its owners, sponsors, affiliates, or subsidiaries.