Published on November 7th, 2023

Today, we’ll talk about option spreads. For the longest time, I didn’t know how to write about them or describe how to use them. I’ll take a first cut today. I have had some recent success with using option spreads to generate consistent income. We’ll be using QQQ as our example. Note: We have some bull put option spreads on QQQ. Options are fluid, and we may or may not have these spreads by the time you read this post.

Let’s get the disclaimer out first: The information provided by smilingdad is not investment advice. Trading and investing in financial markets involves risk. You are responsible for your own investment decisions.

What is an option spread?

An option spread is buying an option and selling the same kind of option during the same expiration month. Using QQQ as an example, it might be buying a call option for 365 and selling a call option for 370 that expires on November 17, 2023. I am betting prices will be above 365 on Nov 17. If they are, I make money. If the stock goes above $370, I am fine with losing the extra gains. Someone else can benefit. If the stock is below $365 on Nov 17th, I lose my investment (it’s cheaper to buy the stock directly, my option has zero value). Options are the right to buy or sell shares at a certain price.

Traditionally, you use bull call spreads to bet on an investment going up, and bear put spreads to bet on an investment going down. We flip the script and talk about bear call spreads when you expect an investment to stay the same or down, and bull put spreads when you expect an investment to stay the same or up.

The risks of options

Before we discuss using option spreads to generate income, a note on the pros and cons of options spreads.

Pros:

- Limited risk

- You control how much risk to take

- Generate income in up or down markets

- Can provide diversification if you have option spreads in various industries

Cons

- Dependent on timing

- Dependent on stock direction and magnitude of change

- Commissions may be high

- Requires a margin account

- Requires option trading privileges

- May need significant amount of assets or income first

- Difference between the bid and ask may be wide

- Losses may be more than your initial investment

A QQQ example

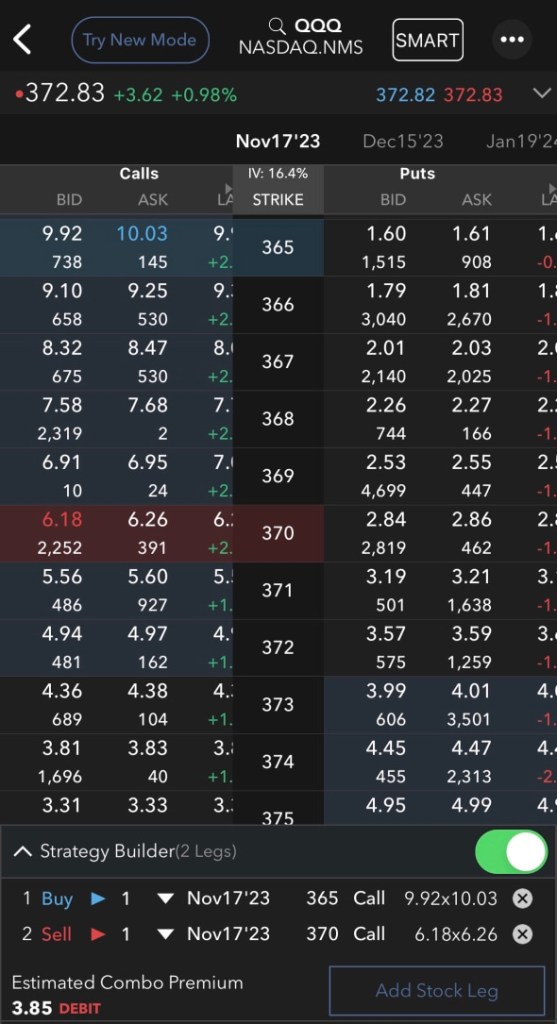

Let’s look at QQQ. Using our broker, this is how a 365-370 bull call spread is entered.

The blue bar signifies we are buying a 365 call. People are willing to buy it at 9.92. People are willing to sell it at 10.03. Until both parties agree, no trades will take place. Each call represents 100 shares. 9.92 x 100 is an investment of $992.

The red bar signifies we are selling a 370 call. People are willing to buy it for 6.18 and sell it at 6.26. 6.18 x 100 shares is $618.

If you buy a 365-370 call spread, you spend $992 to buy a 365 call and receive $618 to sell a 370 call. Your net investment is $992 – $618, or $374. The expected spread is $3.74 ($9.98 – $6.18). If QQQ is 370.01 or more on 11/17, the option spread will be worth $5 (370 current price minus 365 strike price gives you a $5 gain). You’ll need to sell your spread to capture the gains. Your potential gain is $1.26 over $3.74, which can give you a gain of 33.6%. If QQQ is below 365 on 11/17, you’ll lose your entire investment (loss of $3.74 a share).

That’s the problem with bull call spreads and bear put spreads. You need to be right on timing, direction, and magnitude. That’s tough to do on a regular basis. 80% of options expire worthless every month.

What’s the alternative?

The alternative to bull call spreads and bear put spreads are bear call spreads and bull put spreads. In the latter, you are taking the risk from somebody else and get credited with the premium spread difference. You act as an insurance company, with the potential to make low profits spread out over many trades.

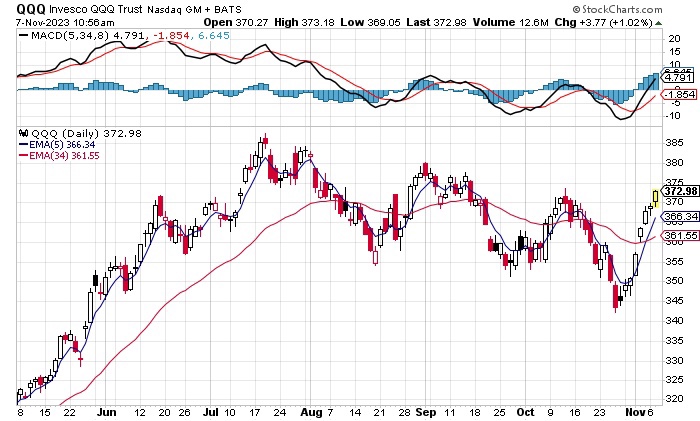

We saw that QQQ was turning up (on a 5,34,8 MACD indicator, the black line turned above the red signal line in the top part of the chart). This signal was given in early November. At the time I sold a 350 put and bought a 345 put. QQQ quickly advanced into the 360’s, which meant each leg of the put spread was worth less. The gain was about $700 over a few days for 10 $5 put spreads. Whatever money was given to us ‘selling’ the spread, we could buy it back for less. The difference was our profit.

For most people, selling what you don’t own and buying it back cheaper later sounds like alchemy. It probably is. It doesn’t make sense outside of the financial markets.

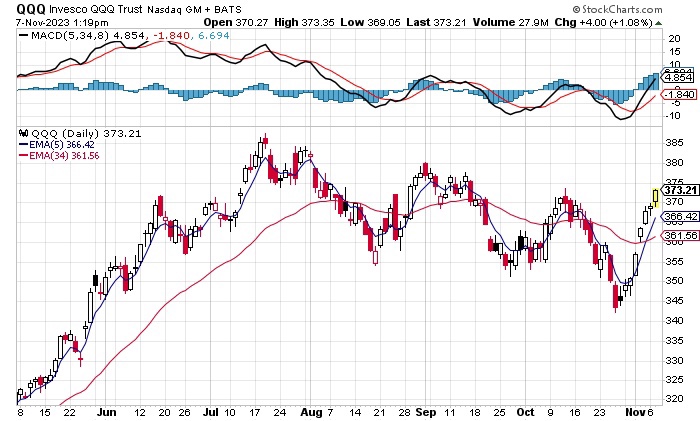

The spread has collapsed to less than 10 cents out of a potential $5, meaning a low chance the spread is profitable on Nov 17th. When we bought it was more than $1. When QQQ rises, a bull put spread will lose value. We can hold the bull put spread to expiration on November 17. If we do, the put spread will expire worthless, saving you the commission costs. As options are day to day volatile, we decided to book the profit, pay the commission, and celebrate the win.

Our goal is to generate $100 a day from writing option spreads.

We’ll cover bear call spreads when the market has peaked and is turning lower. That’s not the case now. Every time we earn a certain amount from writing options, we put it into VMFXX. VMFXX invests in 6-month US Treasury bills. We know we’ll have capital in case things blow up badly.

There is a risk to bet it all and win big. That’s foolish. Prudent investment requires time, discipline and patience, knowing there will be another opportunity. Greed is your enemy. Slow and steady wins every time.

Side note

To generate the same $700 gain on buying QQQ, I could have bought 100 shares of QQQ for $36,000 ($360 x 100 shares). If I sold at $367, I would make $7 per share. My investment return is $700 divided by $36,000, a 1.9% return on investment. A very good return for 2 weeks. It requires more capital at risk than from our option spread. This is why options have inherent leverage over the stock price. With such leverage you can risk far less and make a similar amount of money. You control how much risk to take, what risks you want to take and when you take a risk.

Hope this informative! Ask us any questions you may have.

Sincerely yours,

smilingdad

Copyright ©2017-2023 smilingdad. All Rights Reserved. The content produced by this site is for entertainment purposes only. Opinions and comments published on this site may not be sanctioned by and do not necessarily represent the views of smilingdad, its owners, sponsors, affiliates, or subsidiaries.