Written on October 20th, 2023

Happy Friday! What a week it has been. We spent a lot of time and stress learning how to market our Shopify site. Shopify’s blog platform is awful and made me realize how much better WordPress is for writing. The result: zero sales. 😂 In this piece, we discovered a rent vs buy calculator from Financial Mentor (1).. Our prediction from our Q3 update showed US Treasury 10-yr bond interest rates had a good chance to climb, and today they crossed 5%. Given that interest rates are now at 8% for a 30 yr mortgage, there are many cases where renting will be cheaper.

Let’s take a look.

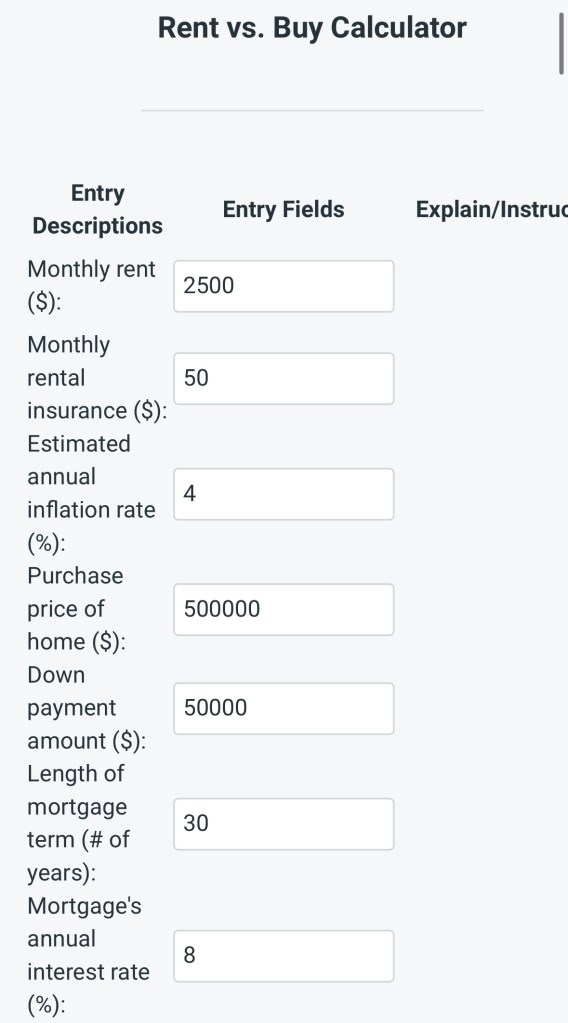

Filling out the calculator

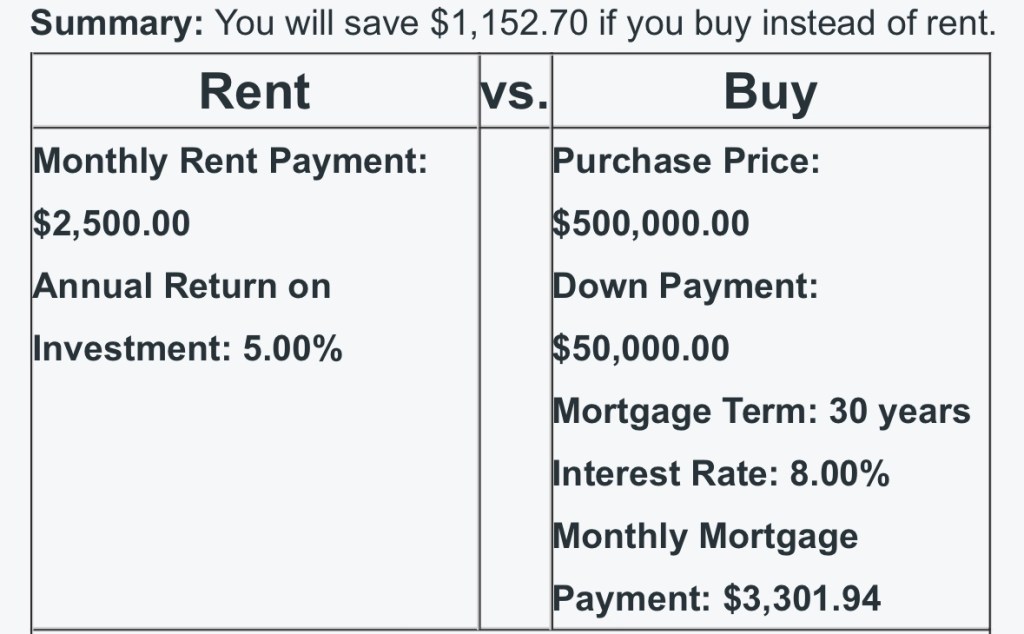

We created a realistic example. Renting a place for $2500 a month and buying a $500,000 house with 8% interest. Which one will save more money? We presume we will stay in the house 8 years if we buy it.

On the first screen, we added our rent, monthly rental insurance, annual inflation rate, purchase price of the house, 10% down payment, 30 years for length of mortgage, and 8% interest rates.

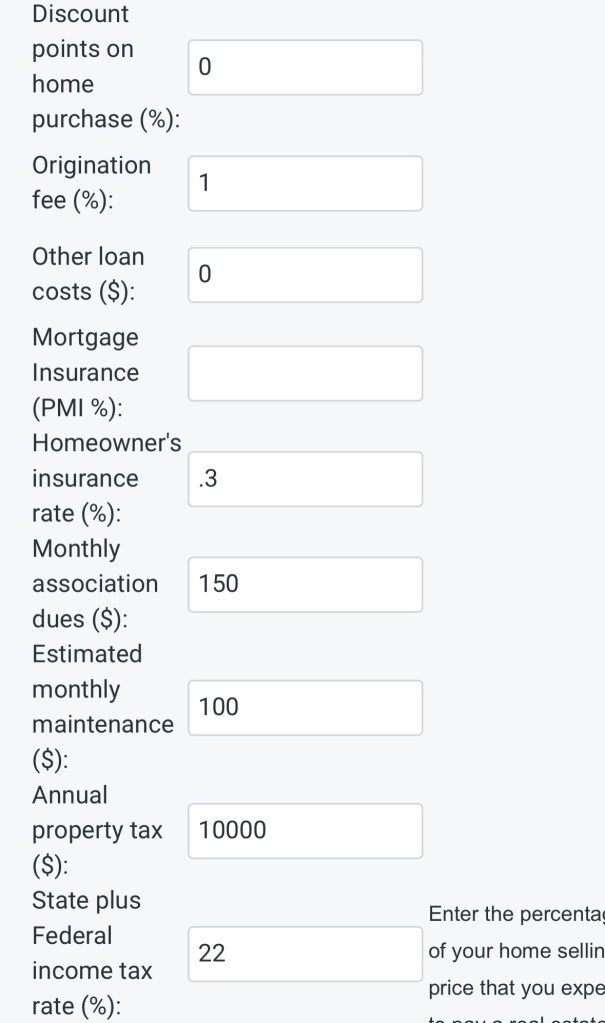

On the second screen, we entered 0% for discount points, origination fee of 1%, .3% home insurance rate, $150 for HOA fees, monthly maintenance of $100, annual property tax of $10,000 (about 2% in Texas), and 22% federal income tax.

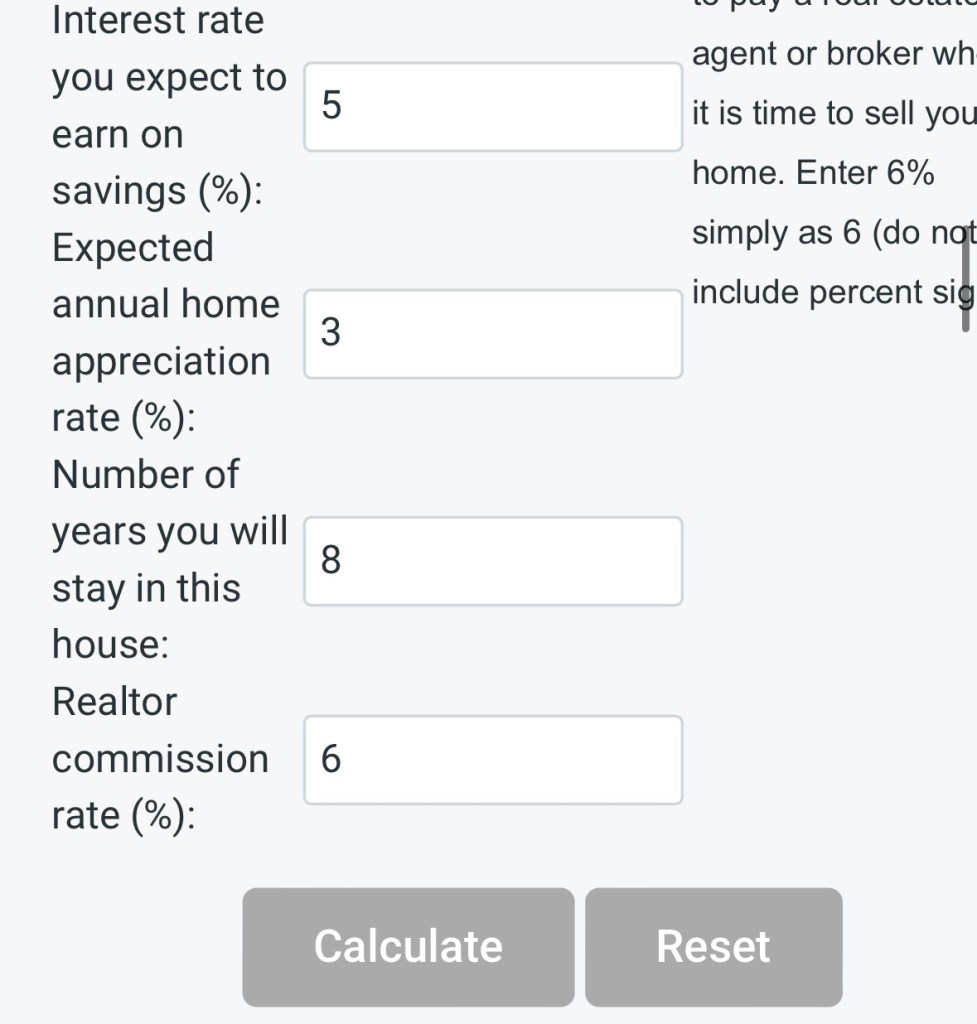

On the last screen, we have our expected savings rate, where we added 5%, annual home appreciation of 3%, 8 years to stay in the home, and a 6% realtor commission when we sell.

Results

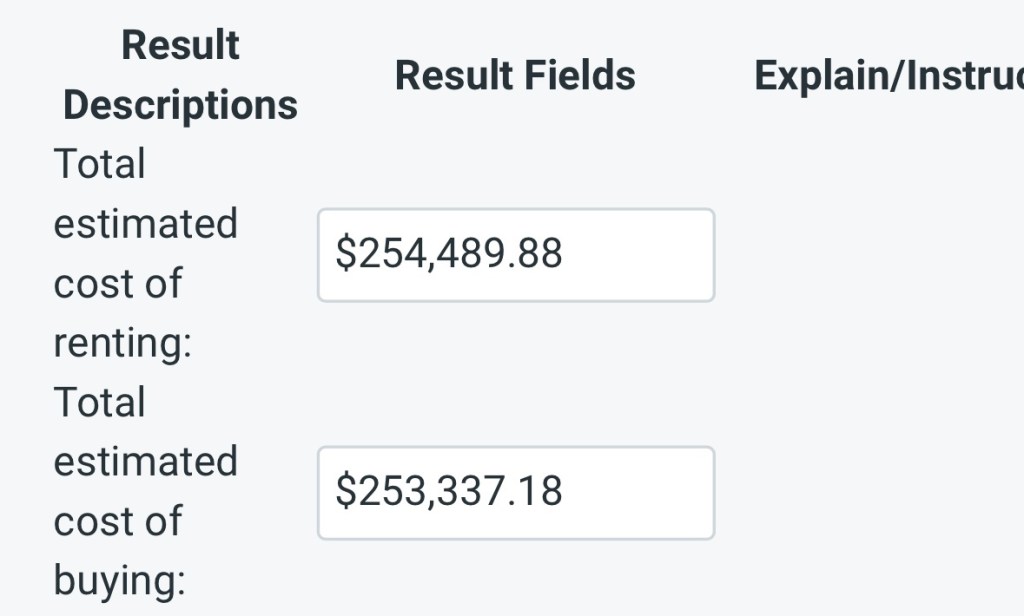

I kid you not that I didn’t know the results would be this close. If you don’t know enough to estimate a field stick with the default.

The calculator gives us a lot of information.

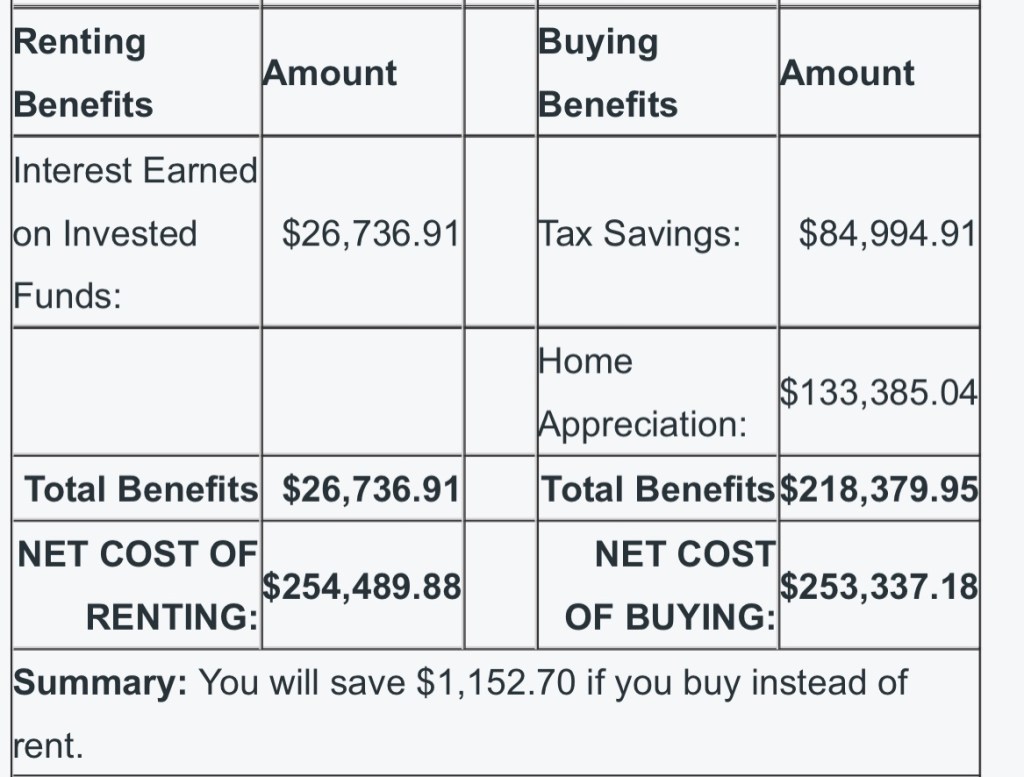

The first panel shows a cost of renting at $254k and buying at $253k.

“Summary: You will save $1,152.70 if you buy instead of rent.”

The next summarizes our assumptions and calculates a mortgage payment of $3300 a month.

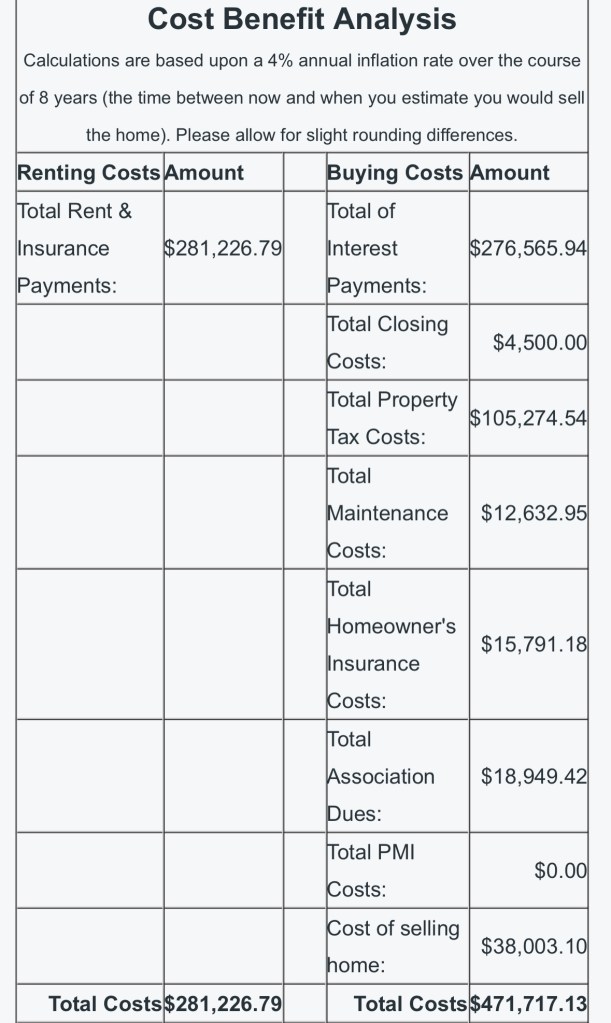

The following section does a Cost / Benefit analysis. The total cost is $281k for a rental and $472k for a house. You may wonder how the final numbers are even when the difference is so wide.

The reason is tax benefits and home appreciation. That lowers our house cost. With a rental only being 1% more than a house, it makes sense to go with a home.

We’ll be covering other useful calendars we found on the Financial Mentor site.

Sometimes the goal is not making money, but to keep what you have.

Sincerely yours,

smilingdad

Copyright © 2017-2023 smilingdad. All Rights Reserved. The content produced by this site is for entertainment purposes only. Opinions and comments published on this site may not be sanctioned by and do not necessarily represent the views of smilingdad, its owners, sponsors, affiliates, or subsidiaries.

Notes:

(1) Financial Mentor Rent vs. Buy Calculator https://www.financialmentor.com/calculator/rent-vs-buy-calculator