Published on October 13th, 2023

We discovered Citi Flex Pay with our Costco card recently. We compare that against AmEx’s Plan It feature and see which one is better. There are good and bad with both. Both are a blessing with unpredictable bills to smooth out cashflow. It is the credit card companies taking on the buy now, pay later industry. Apple joining Buy Now, Pay Later with 0% interest over 3 months will add pressure.

With credit card rates rising, it is in everyone’s best interest to lower delinquency risk. If you miss a payment, your credit score may drop. And if you don’t pay your bill, the companies don’t get paid either. As unsecured debt, the risk is high, which is why companies charge high rates. That, and the Federal Reserve lifted the cap on loans in the 80’s.

Citi Flex Pay (1)

Bad:

- Only 3 and 6 months available

- Have to go through purchase by purchase to use

- As opposed to choosing a balance amount to plan out

Good:

- Easy to use

- Select, split and confirm it

- No application or credit check required

- Eligible for purchases of $75 or greater

- Choose between 3 and 6 month options

- Low fees are unbelievable

AmEx Plan It (2)

Bad:

- Fees are higher compared to Citi Flex Pay

- Purchases start at $100

Good:

- Options for 3, 6, and 12 months

- You can select a balance amount to plan

- Purchases start at $100 or higher

- Select, plan, and confirm

- Built into AmEx cards

Examples

We bought a new dishwasher on our Costco card.

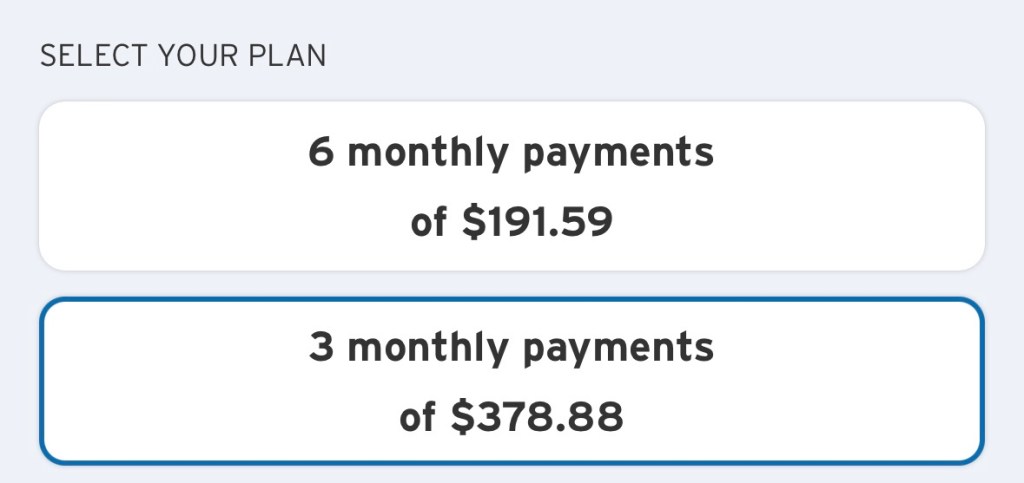

If we select 3 months, our total cost is $378.88*3, which is $1136.64, a difference of 32 cents!!! If you select 6 months, the cost is $1149.54, a difference of $13.22. That’s an annualized interest rate of 2.3%. It’s far better to plan out payments than take the higher interest rate hit. The disbenefit, if you don’t make the payments in full to pay off your balance, you reduce your financial flexibility with higher minimum payments until the buy now, pay it later is complete. We haven’t noticed any upper limits on dollar amounts or transactions yet.

We added an item to our AmEx plan. Fees are $19.08 for 3 months. That’s 2.7% interest every 3 months, or 11.2% annualized. It’s better than usual credit card rates but high compared to a fixed personal loan. Last time we checked, AmEx limited you to 10 Plan It plans. We don’t know if that limit has changed.

Summary

Both plans can give you needed financial space to deal with emergencies or inflation, build up savings, and reduce expense volatility. Don’t overspend and pay later. That gets you back in trouble. If we had to choose, even with the bad on the Citi, the low fees make it the absolutely better plan.

What other buy now, pay later plans do you use?

Sincerely yours,

smilingdad

Copyright © 2017-2023 smilingdad. All Rights Reserved. The content produced by this site is for entertainment purposes only. Opinions and comments published on this site may not be sanctioned by and do not necessarily represent the views of smilingdad, its owners, sponsors, affiliates, or subsidiaries.

Notes:

(1) Citi Buy Now. Pay Later. https://citicards.citi.com/usc/flexpay/default.htm

(2) AmEx BUY NOW, PAY LATER WITH PLAN IT https://www.americanexpress.com/en-us/credit-cards/features-benefits/plan-it/