Written on September 28th, 2023

Note: If you have federal student loans, be very careful before refinancing. Some of the new plans and current interest rates are better than what you get on the private market.

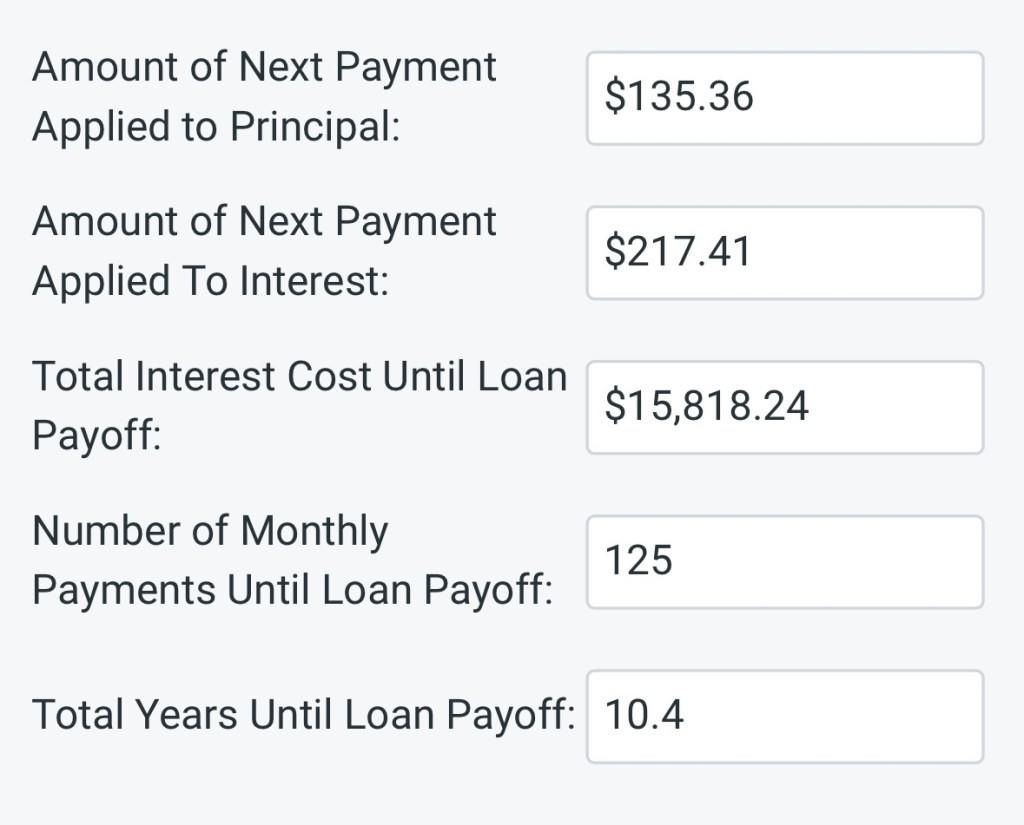

I have a love hate relationship with interest. I love when it is given to me and hate when I have to pay it to other people. Our current variable rate student loan is being paid down aggressively. Every paycheck we are setting aside $250. Once we reach $1000 we are making an extra payment. It’s good to time the extra payment right after the normal payment goes through to maximize principal reduction. We increase our savings to our Debt Destruction Vault with each extra payment reducing interest. Here’s how our current loan looks like.

Under the current loan, we’ll owe $15,818.24 with no extra payments. I have better uses for our money, like the kids 529 plan than paying that much.

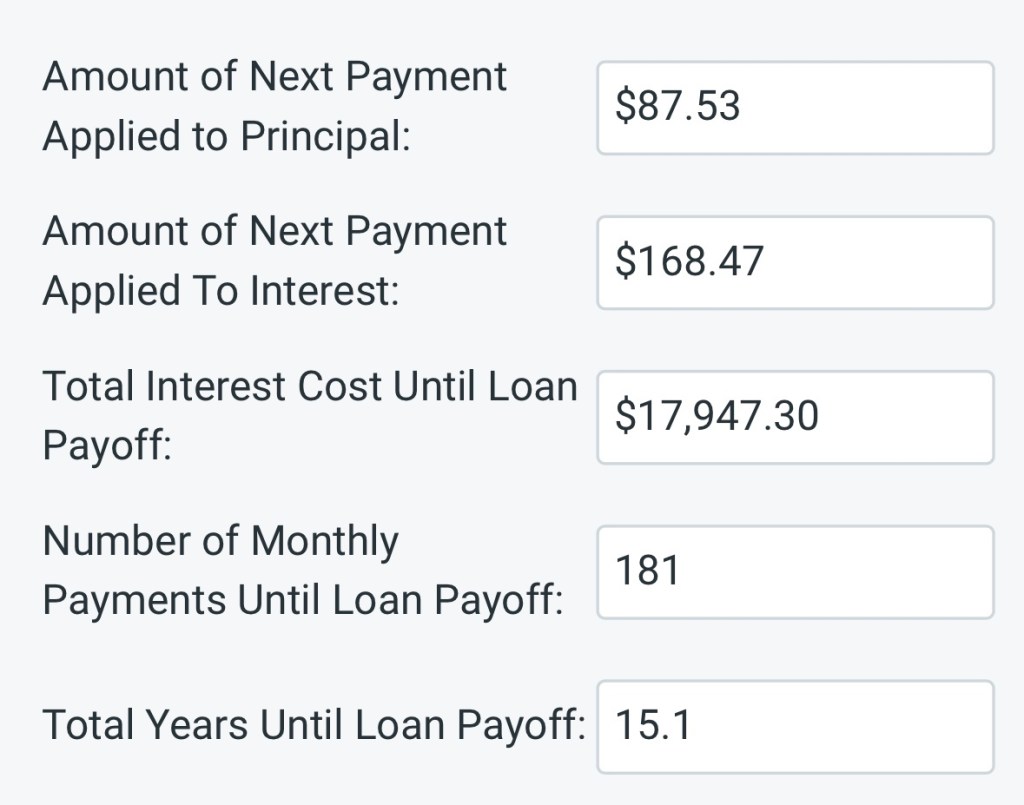

Here’s the new 15 yr fixed rate loan. No more worrying about higher rates as interest rates increase!

Sharp readers will notice the new interest is $17,947.30, which is higher than the $15,818.24 in our original loan. How can that be? The term was extended from 10 years to 15 years, which increases the total interest paid. What happens if we use our old payment with the new interest rate?

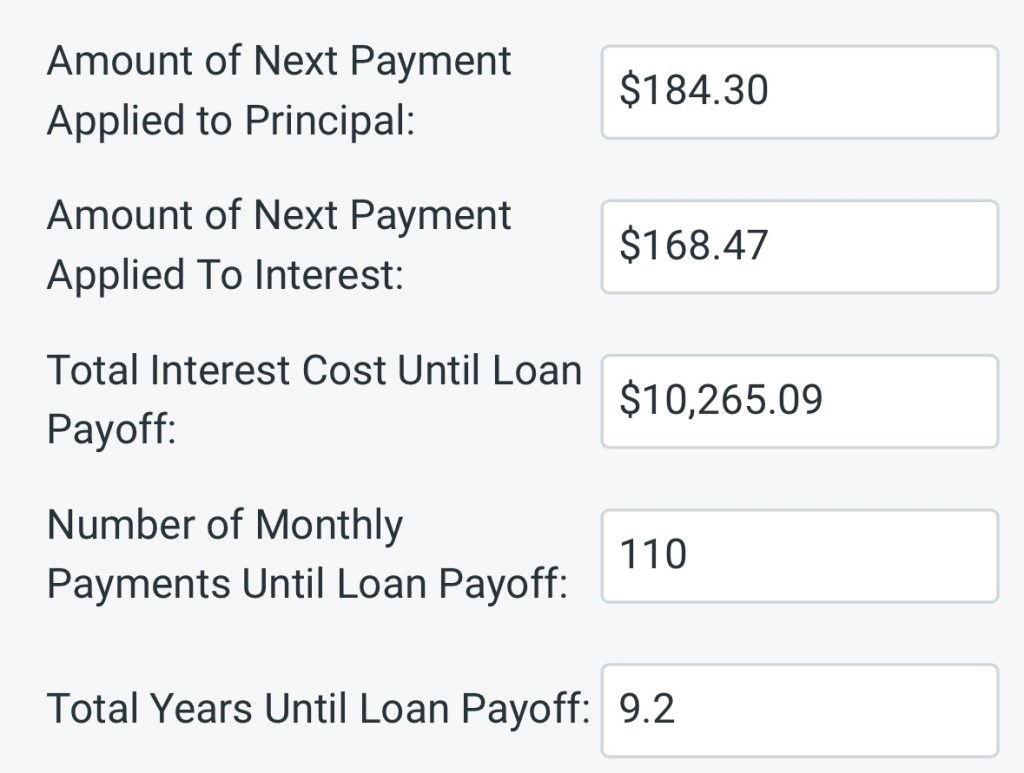

With the same payment as before, and the lower interest rate, the total lifetime interest drops to $10,265.09. We pay off the loan in more than 9 years, compared to more than 10 years before. That’s a difference of $5,553.15 from our original loan. Just from a lousy 2% drop in interest rates! Don’t make the mistake of lowering your payments without looking at the total cost. Most people, myself included, will spend the extra $96.77 a month on consumable garbage without blinking an eye. Once the loan clears, we’ll add $96.77 to our monthly Debt Destruction Fund. This is almost an extra 4 payments a year.

What about the extra $5,553.15 we save? Maybe a nice vacation? Or a down payment on a new car? Or upgrading the patio? Sure, we could do all that. Our answer. NO! We will save the extra every month to make our life better and have less stress. That means an extra $8.41 a paycheck set aside for emergency savings or to make an investment.

We used Splash Financial to refinance. The process was easy. We have no financial incentive to speak highly of them. Check around who has the best terms. Be careful of a hard credit pull! The money for the student loan refinance comes from Bethpage Federal Credit Union. With the lower payments, we’ll decrease our debt to income ratio, which will make it easier to refinance when our adjustable rate mortgage comes due.

Save more money. Lower your interest. Have a better life. What’s not to like?

Sincerely yours,

smilingdad

Copyright © 2017-2023 smilingdad. The content produced by this site is for entertainment purposes only. Opinions and comments published on this site may not be sanctioned by and do not necessarily represent the views of smilingdad, its owners, sponsors, affiliates, or subsidiaries.