Written on: September 5th, 2023

Adjustable Rate Mortgages will reset in the coming years. At current mortgage rates, our house payment will go up 50% in four years. I’m sure we’re not the only ones in a sticky situation. This is not a US only phenomenon. Higher interest rates in the US to fight COVID and the Ukraine war issues have led to higher worldwide inflation rates. For those impacted, we’re terming it ARMageddon. These higher mortgage rates are on top of higher credit card rates, higher auto loans rates, student loan interest resuming, and higher auto insurance.

What is an Adjustable Rate Mortgage?

Investopedia (1) says “The term adjustable-rate mortgage (ARM) refers to a home loan with a variable interest rate. With an ARM, the initial interest rate is fixed for a period of time. After that, the interest rate applied on the outstanding balance resets periodically, at yearly or even monthly intervals.”

How many people are at risk?

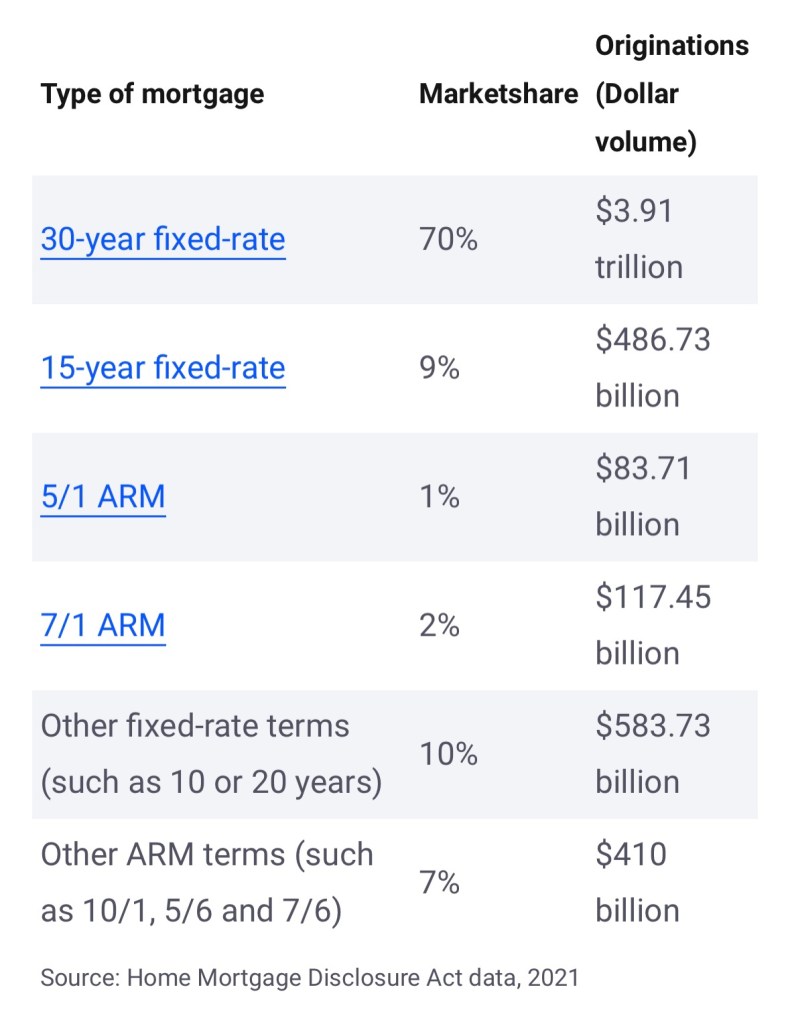

From the above chart, 5/1 ARM’s, 7/1 ARM’s and other ARM terms total about $600 billion in mortgage volume at the end of 2021. This is about 10% of the US market. Thankfully, 90% of the US market has fixed rates. We have a 7/1 ARM. That means the rate is fixed for 7 years, and then the rate changes every 1 year. Our particular ARM has a max interest rate of 8.5%. Our current rate is 3.125%. We won’t be refinancing any time soon.

The situation in the UK is just as bad. The Guardian (3) reported in May “1.5m UK homeowners on variable rate mortgages face new borrowing rise.” The lowest rates on a quick search show 2-yr fixed rates are 5.5%. The Telegraph (4) notes 50,000 homeowners are at risk of falling into negative equity.

Another 1.5 million households with fixed-rate mortgages will see their annual bills spiral by an average £3,000 when they refinance their loans this year, after the average two-year fixed rate jumped from below 2% to 4.75% over the past 18 months.

The Guardian (3)

What can you do?

- Increase your credit score. Higher credit scores lead to lower rates.

- Refinance if possible at an affordable fixed rate for a longer term

- If you have a longer term mortgage before, you may want to refinance to a shorter term mortgage to incur less interest. Shorter term mortgages have lower rates.

- Pay off your other debt, to lower your debt to income ratios

- Increase your career or side job income, to lower your debt to income ratios

- Increase your cash savings to offset closing costs and boost your liquidity

- Talk to your lender if they can help

- Review your signed loan note terms

- See how much your loan goes up, when it goes up, and the limits on any rate increase

- Find out the index used to calculate your rate and track it carefully

- Use a loan calculator to see your new revised payments

- At worst, you may need to rent

- Get help! You are not alone

Our mortgage payment will go up 50% after four years if we use 7% interest rates. The doubling of interest rates doubles our lifetime total interest. We are keeping a close track on when we can refinance and how we can best pay down our mortgage. While we wait, we continue to aggressively pay down our student loans, which are above 9% interest today. Once that is paid off, we’ll re-evaluate to save and earn interest, or to continue paying down debt.

Never give up hope. Despair is the enemy. Have a plan. Learn more. Act on what you find.

Update on 9/7:

Adding this article on CNBC (6) of the troubles facing UK homeowners.

Sincerely yours,

smilingdad

Notes:

(1) Investopedia Adjustable-Rate Mortgage (ARM): What It Is and Different Types https://www.investopedia.com/terms/a/arm.asp

(2) Bankrate U.S. mortgage statistics and FAQ https://www.bankrate.com/mortgages/mortgage-statistics/

(3) The Guardian 1.5m UK homeowners on variable rate mortgages face new borrowing rise https://www.theguardian.com/money/2023/may/11/variable-rate-mortgages-face-rise-borrowing-after-interest-rate-hike

(4) The Telegraph ‘Cost of owning crisis’ as 50,000 fall into negative equity https://finance.yahoo.com/news/cost-owning-crisis-50-000-173854487.html

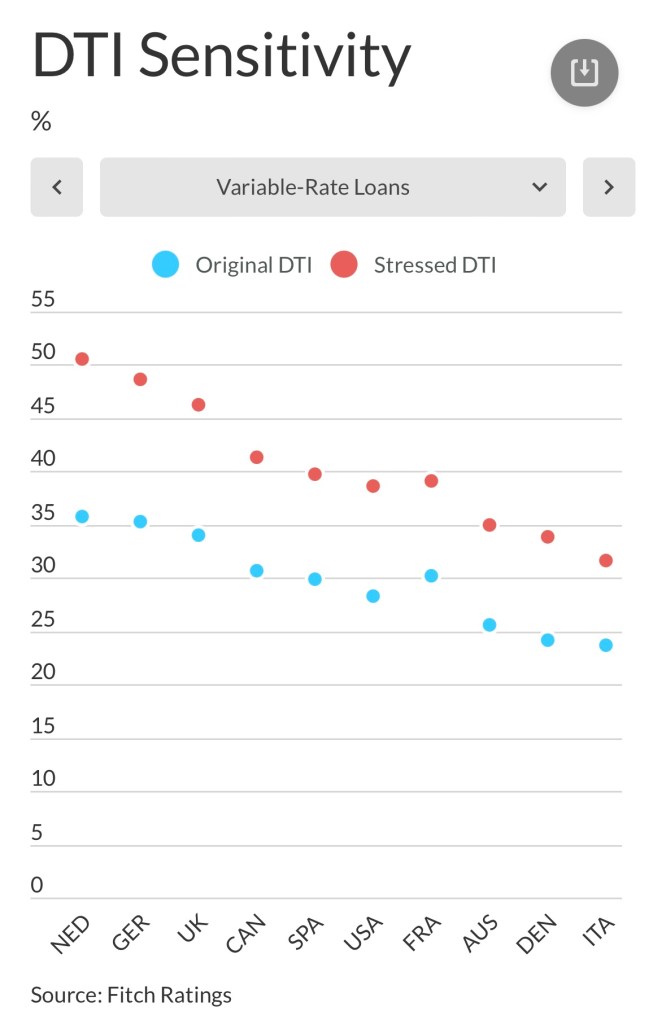

(5) Fitch Ratings Australia, Spain and UK Mortgages Most Exposed to Rising Rates https://www.fitchratings.com/research/structured-finance/australia-spain-uk-mortgages-most-exposed-to-rising-rates-16-05-2022

(6) CNBC Mortgage catastrophe brews in Britain as millions are pushed toward insolvency https://www.cnbc.com/2023/06/26/uk-mortgage-crisis-millions-pushed-toward-the-brink-of-insolvency.html