Written on: 9/1/2023

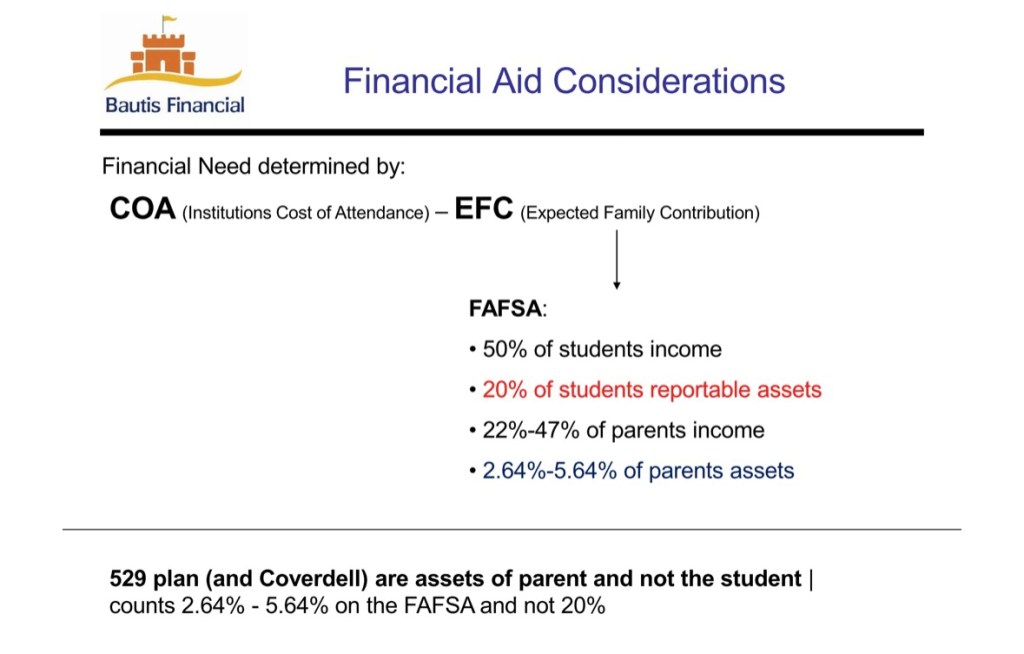

In today’s piece, we’ll cover the combination of income and assets that best helps you with FAFSA (Free Application for Federal Student Aid). Those can include parents income, parents assets, students income, and students assets.

What determines your Student Aid Index?

- The Student Aid Index replaces the Expected Family Contribution starting in financial aid award year 2024-25

- Unlike the Expected Financial Contribution, the Student Aid Index can go negative

- Student income contributes the most towards the Student Aid Index at 50% above $9,400 in student income

- Second is parents income, between 22% to 47%

- Third is all students reportable assets at 20%

- Fourth is parents reportable assets at 2.64% to 5.64%

- Parents reportable assets excludes retirement accounts, a primary home, and life insurance policies

- Parents reportable assets includes checking, savings, CDs, brokerage accounts, 529 or college savings plans, and equity value of second properties

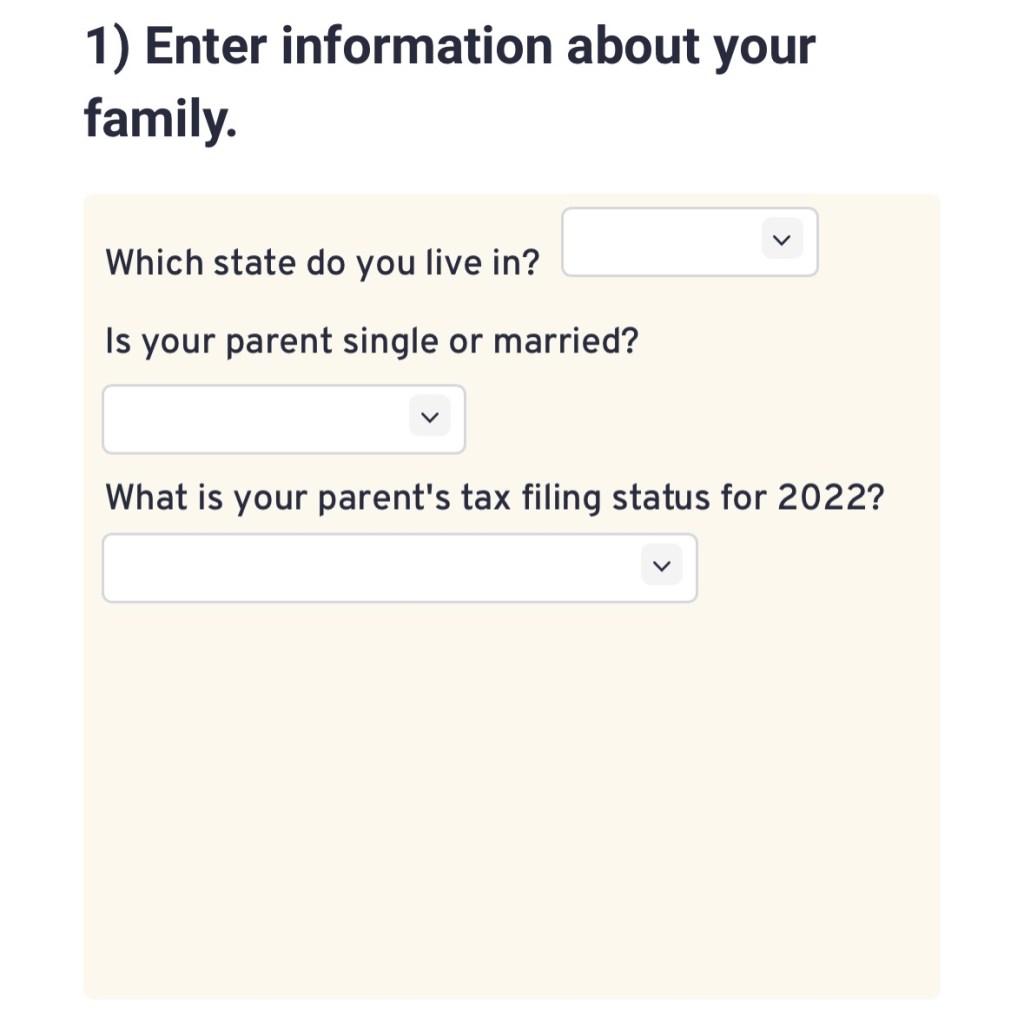

A good FAFSA calculator

- Note: FAFSA calculators change every year it seems

- Make sure to use a calculator with the latest inputs

- We found this calculator easy to use to estimate SAI

- 2024-25 Student Aid Index (SAI) Calculator (2)

Practical points on SAI

- Parents income or assets is better than the student having income or assets

- It seems counterintuitive that an ambitious student working in college would hurt their Student Aid Index more than a student who didn’t work

- For parents reportable assets, they are all treated the same

- Some sites urge you to spend down cash and taxable investments to increase SAI before filing FAFSA

- These same sites say to avoid getting a line of credit or a a cash loan, which increases your cash assets and decreases SAI

- Do what’s best for you to maintain a balance between liquidity, safety, asset diversification, growth, and assets you can’t access easily

- FAFSA asks you to report assets on the day you file

- FAFSA asks you to report income from a few tax years prior

- We recommend filing your FAFSA every year your student attends college

- If a student owns I-bonds, the SAI implications may make it better for the parents to own them. Consult a tax expert for advice.

- Be aware of life insurance that builds up cash value, even if you can take a tax-free loan. The commissions and annual fees are high. Compare saving in a parent-owned 529 plan instead. We started with the MI Saves 529 plan.

- If we had to do it differently, we’d contribute more to a 529 plan than cash-value life insurance (which can come under indexed universal life, whole life, variable indexed universal life, etc.)

- We may need to consider redeeming our I-bonds early

- We’re simplifying our financial picture by closing out Fundrise and our taxable brokerage accounts

- As we said, those parents assets are all treated the same. Might as well add the Fundrise and taxable brokerage accounts to the kids 529 plans if we don’t need the money right away and the money is diversified elsewhere.

- Our income is the larger concern. Could we manage with one income to increase SAI while paying regular expenses, saving, and college? Probably not, but that discussion needs to take place.

My father took care of FAFSA when I applied to college. I had very little idea how it was done. We hope this series on FAFSA, financial need, and student loans gives you insight on better navigating the process before college starts. FAFSA opens on 10/1/23. Make sure to have your documents ready before filling it out.

Sincerely yours,

smilingdad

Copyright © 2023 smilingdad. The content produced by this site is for entertainment purposes only. Opinions and comments published on this site may not be sanctioned by and do not necessarily represent the views of smilingdad, its owners, sponsors, affiliates, or subsidiaries.

Notes:

(1) Bautis Financial The Expected Family Contribution (EFC) for Financial Aid Eligibility https://bautisfinancial.com/the-expected-family-contribution/

(2) College Money Method 2024-25 Student Aid Index (SAI) Calculator https://www.collegemoneymethod.com/2024-25-student-aid-index-sai-calculator/

(3) fsapartners.ed.gov 2024-25 DRAFT Pell Eligibility and SAI Guide https://fsapartners.ed.gov/sites/default/files/2022-11/202425DraftStudentAidIndexSAIandPellGrantEligibilityGuide.pdf (too long; don’t read, unless you really love complicated formulas and details)