What is the SAVE plan?

The Savings on a Valuable Education (1), or SAVE plan, is a new student loan repayment plan launched by the Biden-Harris administration. According to CNBC (2), “The Biden administration expects as many as 20 million people could benefit from its new program.”

What makes SAVE different?

- Single borrowers earning less than $32,800, or a family of four making under $67,500, will not owe loan payments anymore if they enroll in the option

- Instead of borrowers paying 10% of their discretionary income, borrowers will eventually be required to pay only 5% of their discretionary income when the pLan goes live

- This will be available to borrowers in July 2024 when the plan is fully implemented

- Borrowers with undergraduate and graduate loans will pay a weighted average between 5% and 10% of their income

- The SAVE plan also increases the income exempted from the payment calculation to 225% of the poverty line, from 150%

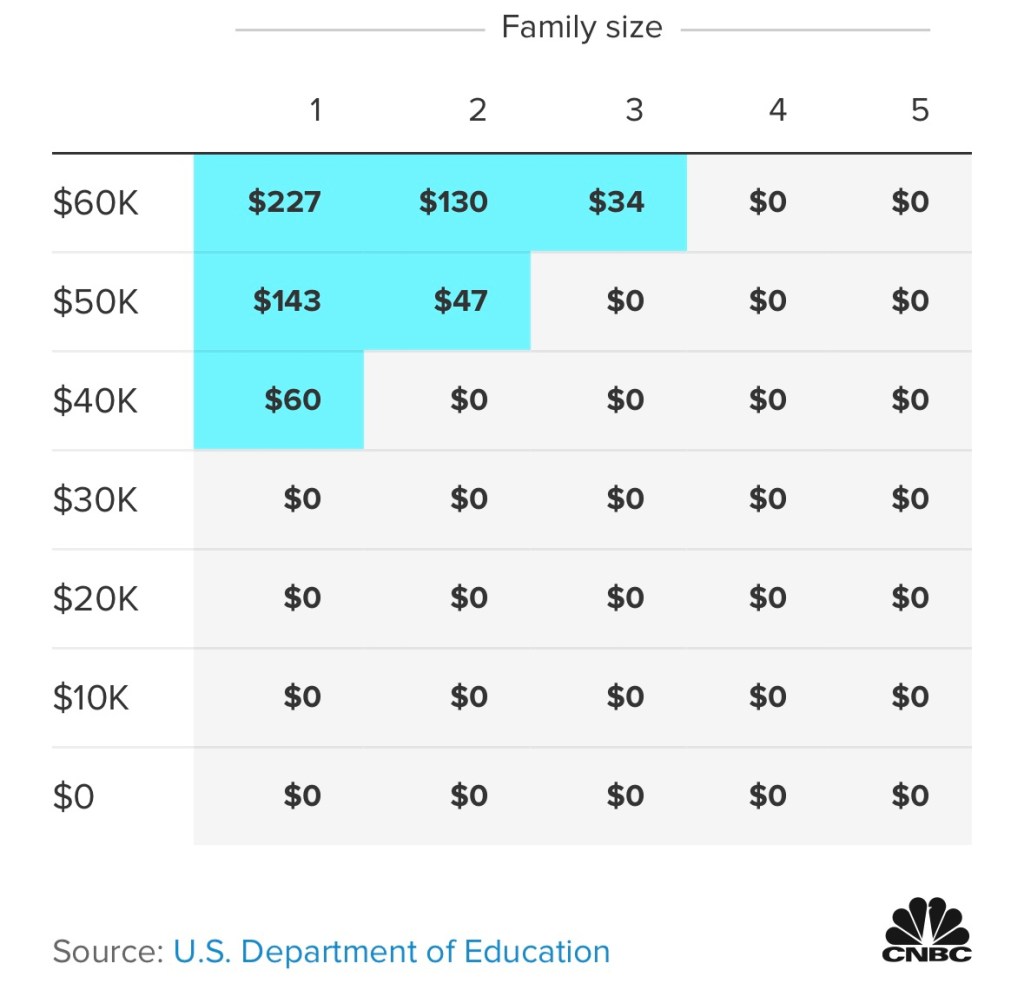

- A chart shows the dramatic payment reductions by family size and income under the new plan

What are the impacts of SAVE on people?

- Remember, the SAVE plan only impacts you if you have federal student loans, not private

- Make sure to understand the plan fully and sign up if it will help you

- Apply here: https://studentaid.gov/announcements-events/save-plan (3)

- Student loans are not dischargeable in bankruptcy

- There is anecdotal evidence that decreased student loan payments will increase mental well being, savings, family formation, home ownership, and retirement savings

- Having an end in sight to paying off your student loans is a huge relief and mental burden removed

- The economy benefits when people are not weighed down with increasing loans and interest over decades

- That strengthens the tax base, allowing the government to help more people

- Overall, this seems like a huge win for those suffering under crushing student loan debt

- As our recent focus on 529 plans shows, educating more people broadens the opportunities for the individual and society as a whole

- A history of public and private college costs on Stacker (4) is eye opening

Happy that so many people will get student loan help.

Sincerely yours,

smilingdad

Copyright © 2023 smilingdad. The content produced by this site is for entertainment purposes only. Opinions and comments published on this site may not be sanctioned by and do not necessarily represent the views of smilingdad, its owners, sponsors, affiliates, or subsidiaries.

Notes:

(1) Ed.gov How the New SAVE Plan Will Transform Loan Repayment and Protect Borrowers https://www2.ed.gov/policy/highered/reg/hearulemaking/2021/idrfactsheetfinal.pdf

(2) CNBC These student loan borrowers will see their monthly bill drop to $0 under Biden’s new SAVE plan https://www.cnbc.com/amp/2023/08/22/student-loan-borrowers-may-see-their-bill-drop-to-0-under-save-plan-.html

(3) Studentaid.gov SAVE Repayment Plan Offers Lower Monthly Loan Payments https://studentaid.gov/announcements-events/save-plan

(3) Stacker How college costs have changed in the last 50 years https://stacker.com/education/how-college-costs-have-changed-last-50-years