Spoiler: There is no best 529 plan. It’s highly dependent on which state you live in, your income, wealth, educational preferences and goals.

Today, we discuss the “best” 529 plan. We’ll be covering the Michigan, Utah, New York, and Ohio 529 plans.

What is a 529 plan?

Morgan Stanley (1) says “They’re tax-advantaged investment plans offering considerable benefits that can help families save for an array of educational costs.”

Why are they useful?

Morgan Stanley gives five, broad reasons.

- Considerable income tax benefits to Account Owners

- There are no age or income limitations

- They can help with estate planning

- They have minimal impact of 5.64% on financial aid

- The plans vary by state, giving you lots of flexibility to find one meeting your needs

Other reasons I have seen:

- Many state 529 plans have $25 minimum’s to start

- The money grows tax-deferred

- Pay no federal taxes on qualified withdrawals

- You can use up to $10,000 per account to pay for student loans

- Up to $35,000 can be transferred to a Roth IRA, once the account has been open for 15 years

- The 529 plan can be used for elementary, middle, and high school tuition expenses

- Can cover college tuition and fees, room and board, school-related services, and computer costs, minus any tax-free educational assistance

- Use at any eligible 2- or 4-year college or university, vocational or technical school, or graduate school in the United States or abroad

- Grandparents and friends can contribute to your beneficiary’s account, sometimes by an easy gift link

- Maximum contribution limits are very high per beneficiary

What state plans do experts like?

We checked a variety of sites. For the most part there was no common consensus what qualifies as “best” for everyone. That included Forbes, Saving for College, Investopedia, Bankrate, Money, CNBC, USA Today, Benzinga and Morningstar. From what we can tell, New York and Ohio plans get universal high praise. Morningstar mentioned Michigan and Utah as their Gold tier of plans this year.

Ohio’s College Advantage

Bankrate (2) notes the following advantages for Ohio’s plan.

- Choose a portfolio based on when the money is needed (target enrollment funds)

- Target enrollment funds automatically glide down to a more conservative level the closer your child gets to college

- Another option are portfolios based on risk level

- Risk level portfolios aim for a constant level of risk, such as moderate, standard and aggressive

- The Ohio plan offers an FDIC Insured bank account as one option

Other considerations:

- Ohio uses Vanguard funds, well known for their low yearly fees

- Annual fees range from $1.49 to $4.35 for $1000 invested

- The plan is available for Ohio and out-of-state savers

- The plan offers $4000 in state tax deductions for Ohio residents

- Th maximum you can contribute to an Ohio plan per beneficiary is $523,000

- The minimum to get started is $25 to open an account

- Grandparents, family and friends can add money to your beneficiary’s account via Ugift

- Same child can have combined account balance of $523,000

- Morningstar (3) rates the plan Silver out of Gold

New York’s 529 College Savings Program

Bankrate (4) notes the following advantages for New York’s plan.

- Available to residents of any state

- New York uses Vanguard funds, well known for their low yearly fees

- Nice state tax deductions, up to $5,000 single filers and $10,000 for joint filers

Other considerations:

- You pay only $1.20 in fees per year for every $1,000 you invest in the plan (0.12% total annual asset-based fee)

- No advisor fees, commissions or account maintenance fees, which other plans may charge

- 20 Target Enrollment Portfolios

- 14 Individual Portfolios

- Grandparents, family and friends can add money to your beneficiary’s account via Ugift

- Same child can have combined account balance of $520,000

- Morningstar (3) rates the plan Silver out of Gold

Michigan Education Savings Program

Morningstar (3) notes the following advantages for Michigan’s plan.

- Choose a portfolio based on when the money is needed (target enrollment funds)

- Plan features highly rated Vanguard, iShares, Schwab, and TIAA-CREF funds

- Plan continues to be among the cheapest in the industry

Other considerations:

- You pay $0.65 to $1.85 in fees per year for every $1,000 you invest in the plan

- No application, cancellation, change-in-beneficiary, change-in-investment-options, loads or sales charges, commissions, or transfer fees

- Options include Enrollment Year (10) investment, Multi-Fund investment (6), Single Fund investment (5), and Guaranteed investment (1)

- Grandparents, family and friends can add money to your beneficiary’s account via Ugift

- Same child can have combined account balance of $500,000

- Morningstar (3) rates the plan Gold

Utah my529

Morningstar (3) notes the following advantages for Utah’s plan.

- Received a Gold medal every year since we debuted our ratings in 2012

- Moved to target enrollment structure in 2021

- Allows investors to build custom age-based portfolios using Vanguard and DFA funds

- State employs its own experienced investment team

Other considerations:

- Available to residents of any state

- Annual fees range from $1 per $1000 invested (static investment) to $4.55 per $1000 (customized investment option)

- 12 Target Enrollment Date portfolios

- 10 Static options

- Customized Age-Based or Customized Static available

- Tax Deduction for Utah residents: For single filers, 4.65% amounting to up to $106/yr per beneficiaryFor joint filers, 4.65% amounting to up to $212/yr per beneficiary

- Same child can have combined account balance of $540,000

- Grandparents, family and friends can add money to your beneficiary’s account via my529 Gift

- Morningstar (3) rates the plan Gold

A note on saving vs borrowing

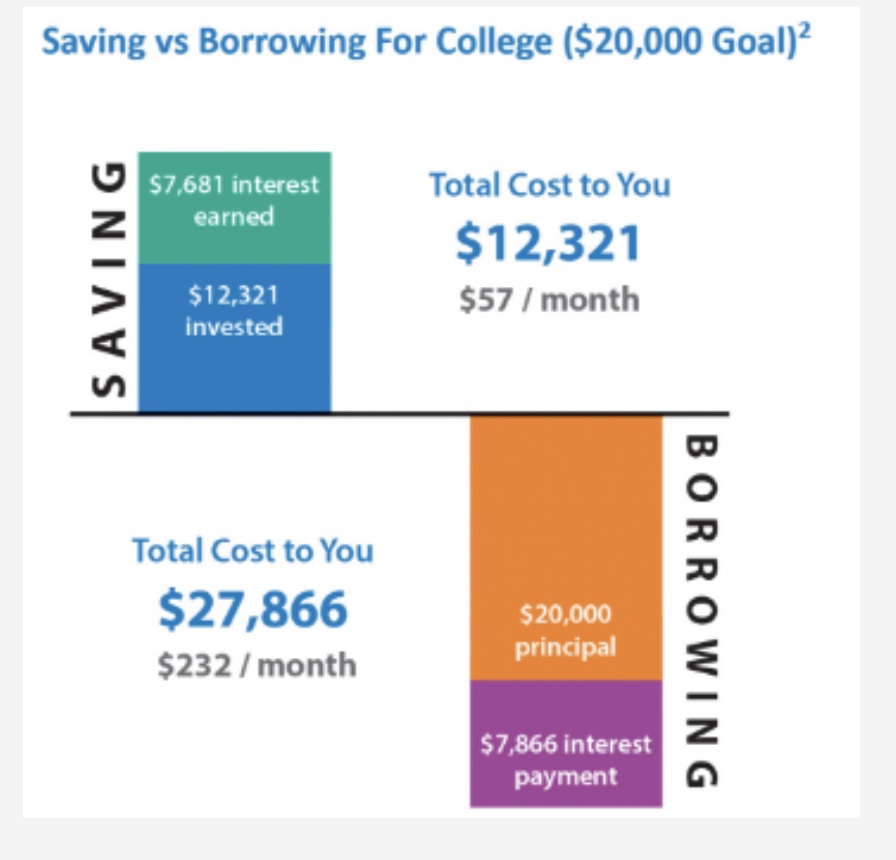

If you saved and invested early enough, the cost is $57 a month. If you were forced to take a loan and pay interest, the cost is $232 a month. Big difference to your wallet. It’s better to save smaller amounts earlier on. Even if you got $0 in gains, assets saved plus $8,000 in borrowing would be cheaper than borrowing the whole $20,000.

Given the high cost of college and mortgages, avoid getting into debt and if you have to get into debt, reduce the amount owed as fast as finances allow. The entire economic system is predicated on leveraging exponential growth. Science tells us exponential population growth eventually leads to exponential population collapse as resources get depleted. It might explain the boom and bust in economic cycles. Those cycles serve to increase wealth inequality, as the rich always get richer.

The best gift you can give your children is a life full of opportunities. Education is the great equalizer.

Sincerely yours,

smilingdad

Copyright © 2023 smilingdad. The content produced by this site is for entertainment purposes only. Opinions and comments published on this site may not be sanctioned by and do not necessarily represent the views of smilingdad, its owners, sponsors, affiliates, or subsidiaries.

Notes:

(1) Morgan Stanley 5 Things You May Not Know About 529s (But Should) https://www.morganstanley.com/ideas/529-plan-benefits-you-may-not-know

(2) Bankrate How to pick the best 529 plan https://www.bankrate.com/investing/best-529-plans/#ohio

(3) Morningstar 529 Ratings: The Top Plans and What They Offer https://www.morningstar.com/personal-finance/morningstar-529-ratings-top-plans-what-they-offer

(4) Bankrate How to pick the best 529 plan https://www.bankrate.com/investing/best-529-plans/#new-york