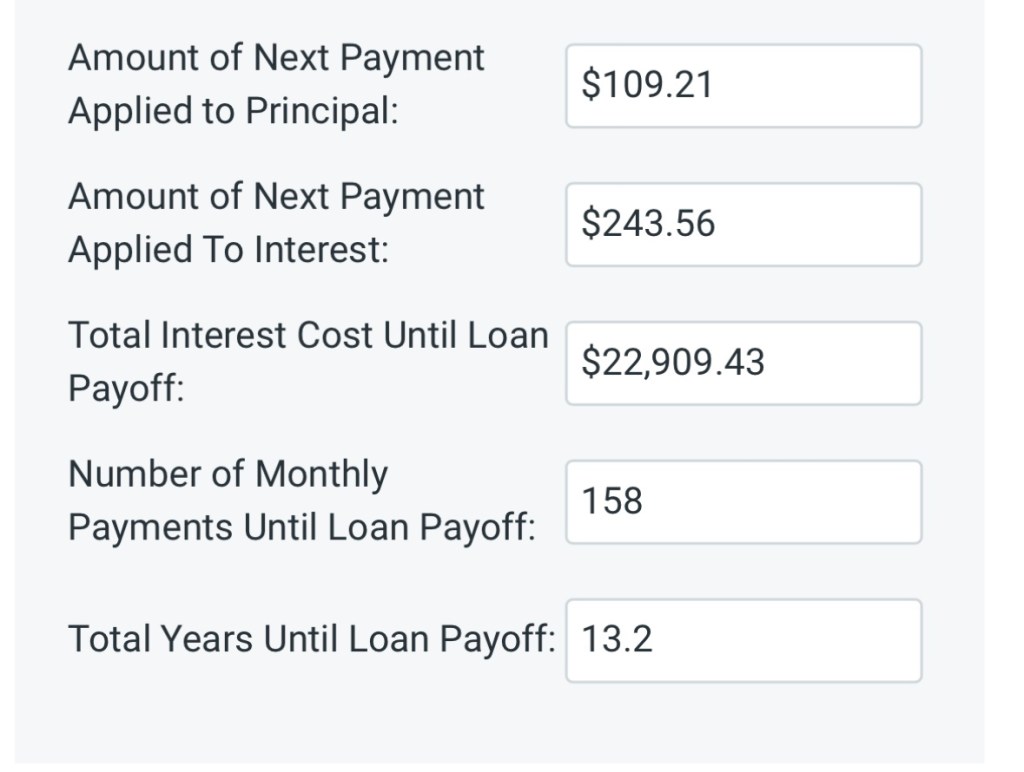

Previously, we have talked about saving up and making large payments at once to reduce interest. We were finding it difficult to calculate the total loan interest, especially if we were already making payments for some time. I found this calculator (1) from Financial Mentor that replicated what I did manually in Google Sheets.

Let’s dive further.

Above is our current student loan. You can see why we are anxious to pay it off. At an interest rate of 8.99%, the Rule of 72 says this loan would double in 8 years if we didn’t make any payments (72 / 9 gives us 8 years to roughly double the principal amount).

The total interest cost is $22,909. When we add in our principal, our total cost is $55,420. That’s enough to pay for a nice new car in cash or many nice travel vacations.

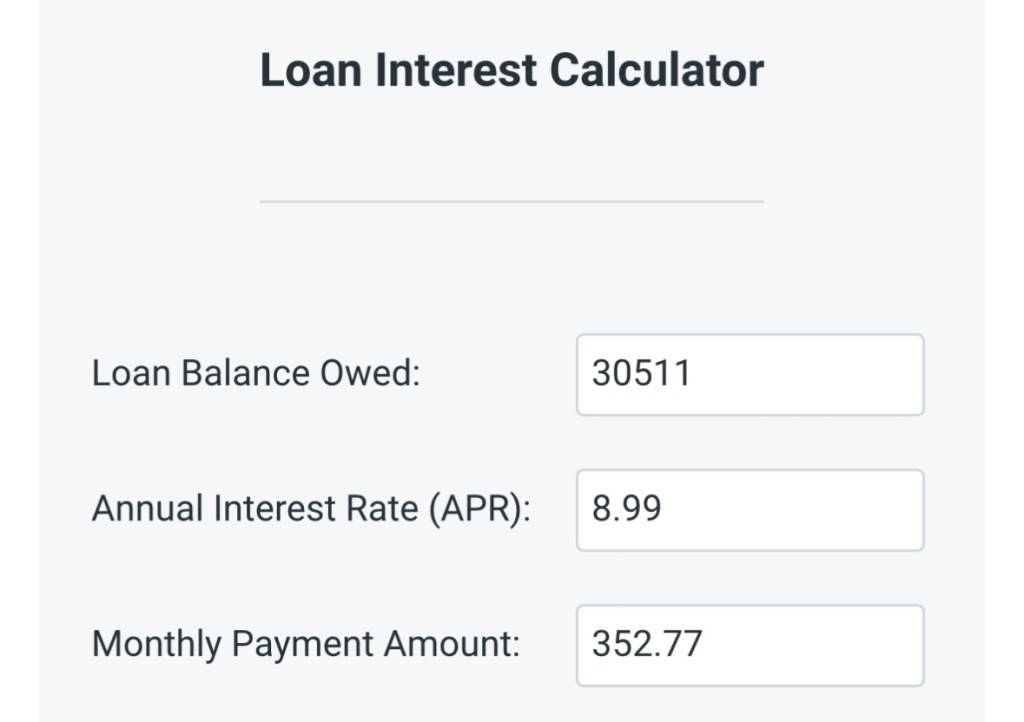

We have saved up $1000 and sold $1000 of Ethereum. Both will be applied to our student loan balance. Ethereum isn’t going anywhere, and it seemed better to use those funds to pay down a high rate of interest. How do the total loan cost numbers change after the payment?

The total interest cost is reduced to $18,832. Our $2000 payment resulted in a $4,077 decrease in interest ($22,909 – $18,832). Without discounting back to the present, that’s a 103% return on payment. That’s pretty good.

We did something extra and created a debt elimination fund with SoFi where money is added after each paycheck. We increased the payment into the fund by $3.15 per paycheck. We got that by dividing $4,077 divided by 18 years, divided by 12 months per year, divided by an average of 6 paychecks a month (I get paid weekly, smilingmom gets paid twice a month on average).

The goal is to take the extra interest savings and actually save it to pay off more debt. Each time we save interest by making early payments, we’ll add more. We doubled our savings by adding another $3.15 to mandatory long term savings per paycheck.

Sure, some people get an endorphin rush from consumption or rewards, we’ve advocated that in the past. At the moment, we get ours from saving. Slow and steady to a better financial future.

Here’s to brighter futures ahead.

Sincerely yours,

smilingdad

Copyright © 2023 smilingdad. The content produced by this site is for entertainment purposes only. Opinions and comments published on this site may not be sanctioned by and do not necessarily represent the views of smilingdad, its owners, sponsors, affiliates, or subsidiaries.

Notes:

(1) Financial Mentor Loan Interest Calculator https://www.financialmentor.com/calculator/loan-interest-calculator