EV sales are growing around the world. Here’s how a few well-known EV stocks are doing.

The largest EV company in the world almost tripled from a low near $100 earlier in the year. A buy signal in the upper chart was given two months ago. Revenue, deliveries, and net income were up, while net profit margin was down, year over year. The company has a goal to sell 2 million EV’s this year. My personal opinion is Tesla is overvalued, but growth companies have a way of remaining overvalued for a long time.

BYD is the largest plug-in and EV maker in the world. Revenue, deliveries, net income, net profit margin, and operating income are all up strongly, year over year. The company has a goal to sell 3 million new energy vehicles this year. Buy signals in the upper panel were given two months ago.

Note that Rivian doesn’t have enough history to generate buy or sell signals. It’s speculative at this point until we are assured it has staying power as a company. Rivian matched EV leaders with a strong move up last month. The company has losses but the company’s financials are moving towards smaller losses.

Lucid has a similar chart as Rivian. There is not enough history to determine when to buy and sell. Whereas Rivian stock has turned around, Lucid is languishing near lows. Lucid raised almost $3 billion in June from Saudi Arabia.

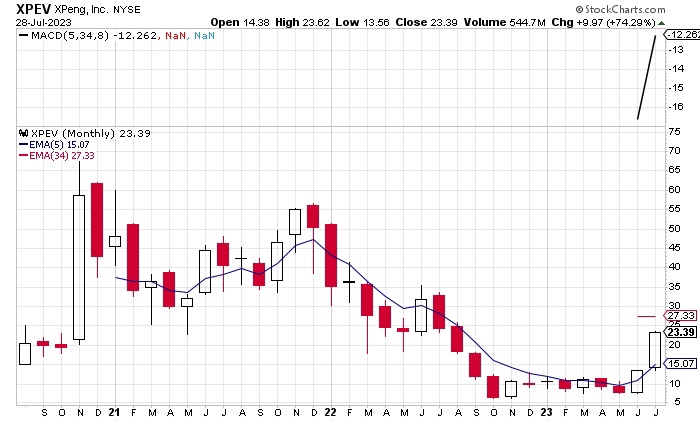

Xpeng, a Chinese EV company, is making a move higher. Earnings will arrive on August 22, 2023. Our indicator in the top box is gathering data.

Nio gave a buy signal on our monthly 5,34,8 MACD ( moving average convergence divergence indicator). We bought some more shares last week. Nio will report earnings on September 6th, 2023.

Li Auto is near all time highs. No buy signal yet, we’re keeping a close eye on it. Next earnings is August 8th, 2023.

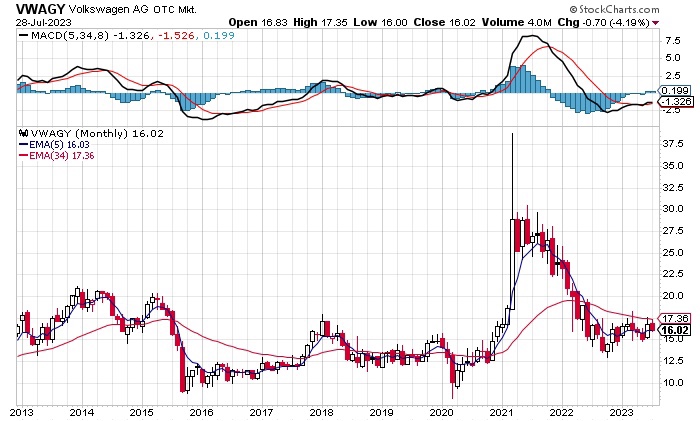

VW’s stock is struggling after giving a buy signal. They are ramping up EV sales. Revenue went up, net income went down, and net profit margin went down, year-over-year.

Which EV stocks would you like us to cover in our next update?

Sincerely yours,

smilingdad

Copyright © 2023 smilingdad. The content produced by this site is for entertainment purposes only. Opinions and comments published on this site may not be sanctioned by and do not necessarily represent the views of smilingdad, its owners, sponsors, affiliates, or subsidiaries.